MercoPress. South Atlantic News Agency

Mexico inaugurates new IMF flexible credit line with record 47 billion USD

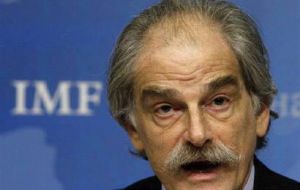

Lipsky reformed IMF extends flexible loans not conditioned to policy targets as in traditional supported programs

Lipsky reformed IMF extends flexible loans not conditioned to policy targets as in traditional supported programs The International Monetary Fund on Friday approved a previously agreed 47 billion US dollars line of credit for Mexico, the first country to qualify for the new lending facility for strong-performing emerging economies. However Mexican authorities have stated they intend to treat the one-year arrangement as precautionary and do not intend to draw on the line.

“Today is a historic occasion,” said IMF First Deputy Managing Director John Lipsky. “The IMF Executive Board has approved the first Flexible Credit Line arrangement and, at the same time, the largest financial arrangement in the Fund’s history. The approval of this arrangement for Mexico represents the consolidation of a major step in the process of reforming the IMF and making its lending framework more relevant to member countries’ needs.

“For over a decade, Mexico’s macroeconomic performance has been very strong, exemplified by solid growth with low inflation; a steady reduction in public debt, and strengthened corporate balance sheets; a contained current account deficit; and a profitable and well capitalized banking sector. This has been underpinned by a highly credible and very strong policy framework, including a successful inflation targeting regime that has supported the commitment to the flexible exchange rate; a rules-based fiscal framework; and strong and sophisticated financial sector supervision,” the First Deputy Managing Director said.

The Flexible Credit Line (FCL), which was created in the context of a major overhaul of the IMF lending framework on March 24, 2009, is particularly useful for crisis prevention purposes as it provides the flexibility to draw on the credit line at any time. Disbursements are not phased nor conditioned on compliance with policy targets as in traditional IMF-supported programs.

This flexible access is justified by the very strong track records of countries that qualify for the FCL, which gives confidence that their economic policies will remain strong.

However as the global situation has deteriorated, Mexican asset prices have fallen sharply in line with the global market sell off, and GDP growth has slowed sharply. While Mexico’s underlying fundamentals remain very strong, and the balance of payments position is manageable, the open capital account and close global financial linkages––on top of close trade links with the United States––could expose the country to potential downside risks, points out the IMF release.

The IMF considers that Mexico is an excellent candidate to pioneer this facility since it will play an important role in supporting Mexico’s overall macroeconomic strategy and in bolstering confidence until external conditions improve, complementing the previously agreed swap line with the US Federal Reserve, as well as financing from other multilaterals.

“All told, Mexico’s combination of strong macroeconomic policies, institutional policy frameworks, and economic fundamentals, together with the additional insurance provided by the arrangement under the FCL, provides assurance that Mexico is in a very strong position to manage any potential risks and pressures in the event that the global situation were to deteriorate further” said Lipsky.

Mexican analysts can’t agree on how much the country’s economy will contract in 2009, given its dependency with the US (which absorbs 85% of Mexican exports) but estimates range from -0.9% to -5%.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!