MercoPress. South Atlantic News Agency

Argentine defaulted bond-holders have until 22 April to respond to the proposed payment plan

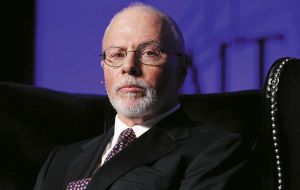

Billionaire hedge fund manager Paul Singer has to decide if he accepts Argentina’s offer

Billionaire hedge fund manager Paul Singer has to decide if he accepts Argentina’s offer A US appeals court gave holders of defaulted Argentina debt three weeks to respond to the country’s proposed plan to pay them much less than the 1.33 billion dollars they have sued to collect.

The Second US Circuit Court of Appeals in New York directed holdout bondholders who did not participate in Argentina’s two debt restructurings following its 2002 default to submit a response by April 22.

These holdouts are led by NML Capital Ltd, a unit of billionaire hedge fund manager Paul Singer’s Elliott Management Corp, and Aurelius Capital Management.

The brief order likely delays any definitive ruling from the Second Circuit until at least late April.

On Friday 29, March, Argentina submitted a payment proposal offering the holdouts, which the country calls “vultures,” just one-sixth of the money they say they are owed.

The litigation arises from the country’s 100 billion dollars sovereign debt default in 2002. Uncertainty over the case has already rattled Argentine credit markets and created fears of a new default.

About 92% of Argentina’s bonds were restructured in 2005 and 2010, with holders receiving 25 cents to 29 cents on the dollar.

But the holdouts demanded full payment, and won a victory in October when the Second Circuit said Argentina violated a clause in bond documents that required equal treatment of creditors.

Then in November, US District Judge Thomas Griesa ordered Argentina to pay the 1.33bn into an escrow account before making its next interest payment to creditors who participated in the restructurings.

The Second Circuit heard Argentina’s latest appeal on February 27.

Argentina’s latest payout plan followed terms accepted by bondholders who swapped their debt in the 2010 restructuring.

Argentina said its plan has an estimated value for NML of 120.6 million, one-sixth of the 720 million it would receive under Griesa’s order. Argentina has estimated that NML paid just 48.7 million for its bonds in 2008.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsI don't think it would take a genius to figure out how this is going to turn out.......

Apr 04th, 2013 - 07:08 am 0I think this another case of Argentina stalling the inevitable.

They know they've completely lost to the funds and are now in the process of dragging out the problem for as long as possible.

tick tock tick tock tick tock

Apr 04th, 2013 - 09:08 am 0I bet they don't take that long

Apr 04th, 2013 - 10:49 am 0It will be a couple 100 word document saying No

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!