MercoPress. South Atlantic News Agency

UK launches legal challenge against the EU financial transactions tax

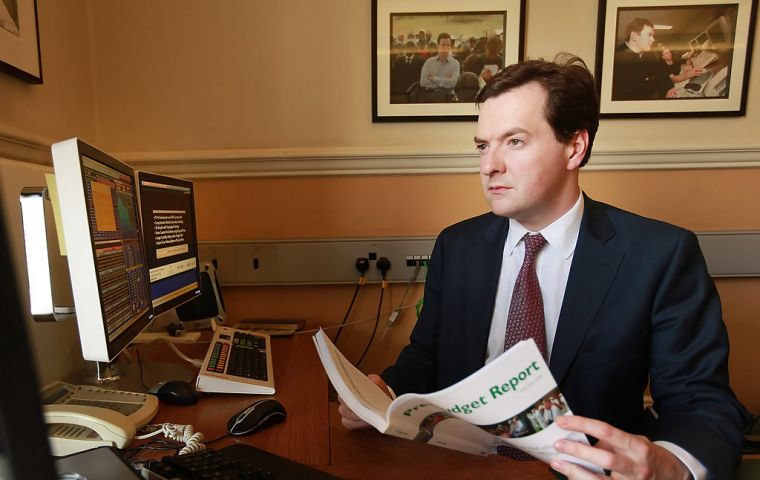

Financial transaction tax “s not a tax on banks or bankers, it’s a tax on pensioners and people with savings and investments” warned Chancellor Osborne (Pic Zimbio)

Financial transaction tax “s not a tax on banks or bankers, it’s a tax on pensioners and people with savings and investments” warned Chancellor Osborne (Pic Zimbio) The UK government has launched a legal challenge against plans for a European financial transactions tax (FTT), according to the BBC. The FTT will be adopted by 11 EU states, but not by the UK and Ministers fear it could be imposed on UK firms trading with businesses based in one of the 11 states.

The 11 countries are Germany, France, Italy, Spain, Belgium, Austria, Portugal, Greece, Slovenia, Slovakia and Estonia.

The BBC explained that if, for example, a British firm trades with branches of French or German banks based in the capital, the British government would have to collect the tax but would not be allowed to keep it.

BBC business editor Robert Peston said that, by increasing the costs of these deals, there could be big falls in the value of business carried out in the City, running to many billions of pounds.

“We think that the financial transaction tax which the European Commission has put forward is not right for Britain”, UK Chancellor George Osborne told the BBC and said an application had been lodged at the European Court of Justice.

“Britain doesn’t want to take part but it also doesn’t want to be caught in the effects of this tax being introduced by other countries. Let’s be clear - financial transaction tax is not a tax on banks or bankers, it’s a tax on pensioners and people with savings and investments,” the Chancellor adds.

The BBC reports that a European Commission spokesman said: “We remain confident that the decision to approve enhanced co-operation on the FTT, which was voted by EU member states on January 22, is legally sound.”

“It is fully in line with international law and the principles of the single market. Transactions will only be taxed if there is an established economic link to the FTT-zone, in a way that is fully compatible with the principles of cross-border taxation,” they added.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsmost have either been defeated or over ridden or out voted,

Apr 25th, 2013 - 12:19 am 0try from the outside in,

you might have better luck.

“does not want to be caught in the effects”

Apr 25th, 2013 - 01:20 am 0You have another choice Brits: stop trading with Europe if you don't like their rules.

LOL ....

@2

Apr 25th, 2013 - 06:41 am 0This article is about the UK and how we feel about it yes, but can you see that there are some other notable absences from the list. There are plenty of other countries in Europe that are not happy with the direction it is taking, like the whole of Scandinavia for example.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!