MercoPress. South Atlantic News Agency

Argentina states 'lack of confidence' in mediator Pollack named by Judge Griesa

“It is impossible to hold negotiations right now due to the plaintiffs' persistence in carrying out actions which harm the Republic” said the letter signed by Boccuzzi

“It is impossible to hold negotiations right now due to the plaintiffs' persistence in carrying out actions which harm the Republic” said the letter signed by Boccuzzi  Argentina questioned Pollack's position saying the refusal to negotiate was also “due to the Republic's lack of confidence in you to supervise a negotiation process.”

Argentina questioned Pollack's position saying the refusal to negotiate was also “due to the Republic's lack of confidence in you to supervise a negotiation process.” The Argentine government has turned down a plea from mediator Daniel Pollack to return to the negotiating table with holdout investors, with the Economy Ministry considering that talks with the speculative funds, so-called 'vulture funds', would be inappropriate given the behavior of the litigants.

“It is impossible to hold negotiations right now due to the plaintiffs' persistence in carrying out actions which harm the Republic,” the Ministry held in a letter responding to the court-appointed mediator's request, and signed by the lawyer representing Argentina in the dispute, Carmine Boccuzzi.

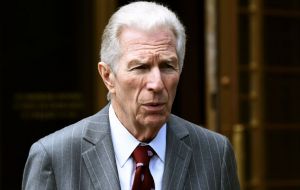

Pollack was named as a mediator by judge Thomas Griesa between Argentina and the holdout investors, who rejected debt restructuring efforts in 2005 and 2010 and demand full repayment on bonds defaulted during the crisis of 2001.

In the letter, the Cristina Fernandez government claimed that the hedge funds suing Argentina “say they want to resolve this conflict consensually, but they have increased their unjustified attacks on Argentina both in and outside the courts”.

The mediator also saw his own position questioned by the Argentine government, which added in the letter that the refusal to negotiate was also “due to the Republic's lack of confidence in you to supervise a negotiation process.”

“In these circumstances, the 'invitation' from the plaintiffs does not mean any possibility of a real solution; rather, in the best of cases, the promise of a reactivation of the media circus which took place last year,” the statement concluded.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsArentina has “ no confidence in Pollack ” who do they want Sepp Blatter?

Jun 02nd, 2015 - 07:03 am 0You got to give it to Killichoff, he pulls every trick to kick the can down the road.

Jun 02nd, 2015 - 09:25 am 0The vultures shouldn't waste their time and just wait until after our elections.

Griesa will add in the “me too” debt over this...

Jun 02nd, 2015 - 11:29 am 0Meanwhile, Argentina's economy is in a dangerous place. It's racking up debt at a rate unseen since its last default in 2001-02. Revenues increased in Q1 2015 compared to the same time in 2014, but expenditures and interest payments have increased by far more.

As economist Claudio Loser of Centennial Group pointed out in a recent note, these calculations don't include any payments to NML or other creditors either.

“These numbers mean that during the first quarter, the overall financial deficit of the public sector increased by 206 percent from the first quarter of 2014,” Loser wrote.

“If these numbers are projected for the year, Argentina would incur in an overall deficit of about 6 percent of GDP, the highest in the region after Venezuela, on the basis of a nominal increase GDP of about 30 percent. The ratio would be much higher if one believes the official numbers of inflation and of real growth.”

He continued (emphasis ours):

“This is a terrible situation for a country that is in dire financial circumstances. Moreover, it would be the worst fiscal performance in the last twenty years on a cash basis, even worse than 2001-03, when Argentina declared unilateral default.”

In short, now is not the time for Argentina to be adding more to its tab.

But here we are.

Read more: http://www.businessinsider.com/me-too-creditors-added-to-argentina-suit-2015-6#ixzz3bu2mZStQ

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!