MercoPress. South Atlantic News Agency

Brazil's mining disaster impacts BHP Billiton shares on fears of cleanup costs

The cost to the companies, including for cleanup and rebuilding, could top US$1 billion, according to analysts who estimate the mine could be closed until 2019

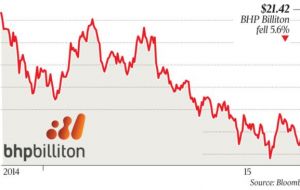

The cost to the companies, including for cleanup and rebuilding, could top US$1 billion, according to analysts who estimate the mine could be closed until 2019  BHP's Australian shares total losses since news of the accident broke out have been more than 7% and the stock is at its lowest level in seven years.

BHP's Australian shares total losses since news of the accident broke out have been more than 7% and the stock is at its lowest level in seven years.  Morgan Stanley analysts said it was unclear whether insurance will cover part of the cost for Samarco, which operates as an independent company.

Morgan Stanley analysts said it was unclear whether insurance will cover part of the cost for Samarco, which operates as an independent company. Investors continued to dump shares in mining giant BHP Billiton Ltd. following the deadly dam burst last week at its jointly owned iron-ore mine in Brazil, even as the company sought to clarify responsibility for the disaster that has already claimed the lives of three people.

The mining giant said it still hasn't determined what caused one dam to fail and another to be “affected” last Thursday at the mine in Minas Gerais state. It said its chief executive Andrew Mackenzie and the head of its iron ore business, Jimmy Wilson, would be in Brazil to assess what further support it could provide for the response effort.

BHP also stressed in an emailed response to questions from The Wall Street Journal that Samarco, the company it 50:50 owns with Brazil's Vale SA, was “responsible for the entirety” of the operations at the iron ore mine.

BHP appoints half of the directors on the board of Samarco, and receives “regular reports” on its operations, the company said. However, it declined further comment on the nature of its oversight of the Samarco company.

Nonetheless, as more information about the extent of the damage caused by the dam burst emerges, analysts are trying to tot up the potential bill for both BHP and Vale SA. The dam breach was the largest-ever spill of its kind, according to Robert Chambers, president of the nonprofit Center for Science in Public Participation, whose group has tracked these types of failures back to 1915.

The cost to the companies, including for cleanup and rebuilding, could top US$1 billion, said Paul Young, a Sydney-based analyst at Deutsche Bank, who estimated the mine could be closed until about 2019. He described the dam burst as “catastrophic.”

BHP's Australian shares total losses since news of the accident broke have been more than 7% and the stock is at its lowest level in seven years. BHP is dual-listed in Australia and the U.K.

BHP said there are three so-called tailings dams used to store mineral waste and water at the mining operation. One burst, spilling the contents into the collection of waste held back by a second--as well as across a rural swath of southeastern Minas Gerais, where it inundated the village of Bento Rodrigues. The third dam is being monitored by Samarco Mineração S.A, the mine's operator, BHP said.

“At this time, there is no confirmation of the causes of the tailings release,” BHP said in its regulatory filing.

Morgan Stanley analysts said it was unclear whether insurance will cover part of the cost for Samarco, which operates as an independent company. Samarco was holding US$700 million of cash and US$4.9 billion of debt on its balance sheet at the end of June, it said.

“Potentially, the Samarco joint venture will have to reapply for its operating and environmental licenses,” it wrote in a note.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsNot surprising. I don't understand why anybody would invest in British equities.

Nov 12th, 2015 - 11:52 pm 0Notice how BHP has gone very quiet now that a Brazilian federal prosecutor has launched a criminal investigation. This is a shame because we will miss the delight of hearing a British company executive state that he (never a she) would prefer to be on his yacht in the Mediterranean than to be involved in cleaning up the mess.

Sometimes staying silent is the intelligent thing to do when there are legal considerations taken into account.

Nov 17th, 2015 - 12:21 pm 0Pity no Argentine or Brazilian leader has ever learnt this trait.

Screeching in the hope that lies will be mistaken for the truth isn't a British trait. Rather, as you have so aptly proven time and time again, it is the trait of many from certain Latin American countries.

BHP Billiton will pay what it is legally required to pay. It is a pity your morals won't let you hold your own government to the same standard.

But then again, what more can one expect from an Argentinean education.

An Australian expatriate (or 'refugee' as we like to term them) colleague tells me that the Brits are now complaining bitterly about the share price and are trying to force the company to welch on their obligations to to Brazil and its people. This British caused disaster is going to take 10 to 20 years to effect even a partial cleanup. The Brazilians should liquidate BHP and use the proceeds to rectify the damage they have caused. This is what the US should have done with British Petroleum in the Gulf!

Nov 20th, 2015 - 02:55 am 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!