MercoPress. South Atlantic News Agency

Meirelles insists on a cap for government spending, if not taxes will have to rise

Meirelles said he was confident the fiscal year deficit will be contained at R$ 170.5 billion (US$ 51.6 billion), despite high spending and falling revenues

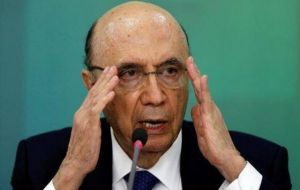

Meirelles said he was confident the fiscal year deficit will be contained at R$ 170.5 billion (US$ 51.6 billion), despite high spending and falling revenues Brazil's Finance Minister Henrique Meirelles has warned that if Congress does not approve a ceiling for public spending, the country will have chosen a most cumbersome path with new rounds of tax increases and higher interest rates which will further delay sustainable growth.

“Brazil will have opted for a choice that I see as wrong and grave, one where the evolution of public debt is not managed, and the country will have to pay a large price for this over the next few years”, said Meirelles, adding support for the approval of a constitutional amendment to limit public spending increase to the previous year inflation correction.

“If it's not approved, there will be no other short cut or magic solution, because over the next few years, the only way to finance the increases in public spending will be to raise taxes”, insisted the orthodox minister in a brief interview with Folha de Sao Paulo.

Meirelles said that he will meet the goal of closing the year with a deficit of R$ 170.5 billion (US$ 51.6 billion), despite the high spending and falling revenues that led the government to adjust projections last week.

Central Bank President during former president Lula da Silva's administration, Meirelles did not want to comment on President Dilma Rousseff's impeachment process, but only said that ending political “uncertainty” will lead to a “greater and quicker recovery” for the Brazilian economy.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!