MercoPress. South Atlantic News Agency

Argentina default “possible”, but not “probable”, says credit rating agency Fitch

Fitch downgraded Argentina’s sovereign debt on Friday from ‘B’ to ‘CCC,’ while S&P lowered its rating to ‘B-‘ from ‘B.’

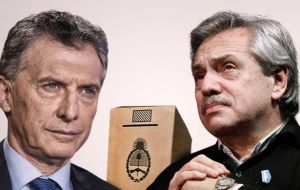

Fitch downgraded Argentina’s sovereign debt on Friday from ‘B’ to ‘CCC,’ while S&P lowered its rating to ‘B-‘ from ‘B.’  Markets were shaken by Fernandez’s wider-than-expected primary election win, which cast doubt on the future of Macri’s free-market economic policies

Markets were shaken by Fernandez’s wider-than-expected primary election win, which cast doubt on the future of Macri’s free-market economic policies  Fitch's McCormack said at a presentation in Buenos Aires that the ‘CCC’ rating means a debt restructuring or default is seen as “possible” but “not probable”

Fitch's McCormack said at a presentation in Buenos Aires that the ‘CCC’ rating means a debt restructuring or default is seen as “possible” but “not probable” Argentina could be downgraded again by Fitch Ratings if further weakness in the Peso boosts the risk of default, the agency’s head of sovereign ratings said in an interview. Argentina has issued billions of dollars worth of bonds denominated in U.S. currency.

Prospects of repaying the debt have dimmed since the peso’s 18% crash last week after business-friendly President Mauricio Macri got trounced in the Aug. 11 primary election by center-left rival Alberto Fernandez, now the favorite to win the October presidential election.

“The Argentine government tends to borrow in foreign currency either domestically or abroad, so that reliance on foreign currency borrowing is the Achilles heel of the sovereign credit here,” James McCormack, Fitch’s head of sovereign ratings, was quoted by Reuters in Buenos Aires.

“It introduces a vulnerability to exchange rate fluctuations that many other countries simply don’t face,” McCormack added.

Fitch downgraded Argentina’s sovereign debt on Friday from ‘B’ to ‘CCC,’ while S&P lowered its rating to ‘B-‘ from ‘B.’ The peso tumbled nearly 20% last week, forcing the central bank to tap into its reserves with dollar auctions.

Markets were shaken by Fernandez’s wider-than-expected primary election win, which cast doubt on the future of Macri’s free-market economic policies and Argentina’s IMF-backed austerity plan.

As Argentina’s main parties had already selected their presidential candidates, the primary election was effectively an opinion poll for the Oct. 27 presidential election.

McCormack said at a presentation in Buenos Aires that the ‘CCC’ rating means a debt restructuring or default is seen as “possible” but “not probable.”

In a subsequent interview, McCormack said policy changes that could increase the likelihood of a default would be a factor in whether Argentina is downgraded further.

“What kind of policies might lead to that? Policies that would result in a further depreciation of the exchange rate and a lack of confidence in the macro framework,” McCormack said.

Economic relief measures announced by Macri last week, including personal income and food tax cuts, would have a slightly negative fiscal effect but not enough to further hurt the country’s credit rating, McCormack said.

Fitch executives said they were scheduled to meet one or two economists from the Fernandez camp while McCormack was in Buenos Aires. They were also scheduled to meet Central Bank chief Guido Sandleris. They are also scheduled to meet Finance Secretary Santiago Bausili and Sebastian Katz, who just joined the team of Macri’s new Treasury Minister Hernan Lacunza.

Alberto Fernandez has said he would seek to “re-work” Argentina’s US$ 57-billion standby agreement with the IMF, whose next review of Argentina’s economy on Sept. 15 should signal whether the lender of last resort still thinks the country can pay its debt obligations. Government bonds denominated in dollars are harder to pay when the peso weakens.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!