MercoPress. South Atlantic News Agency

Fed pleased with latest data but US recovery is still fragile

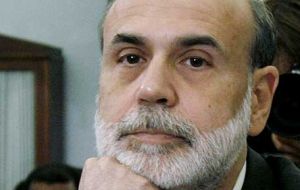

Ben Bernanke: Labour market and consumers still face “considerable headwinds”

Ben Bernanke: Labour market and consumers still face “considerable headwinds” Federal Reserve policymakers were increasingly pleased by signs of improvement in the US economy but added that the recovery is still fragile, according to the minutes of their most recent meeting.

The minutes, released Wednesday, give a more detailed economic outlook than the Fed's brief statement following its meeting three weeks ago. Re-appointed Ben Bernanke and other top officials of the central bank said in the minutes they viewed the economy “as likely to recover only slowly during the second half of this year and all saw it as still vulnerable to adverse shocks.”

Policymakers also indicated that they remain particularly concerned about the state of the labour market -- despite improvements in some employment readings in recent months. Unemployment, which is set to move above 10% this year, may impact on consumer behaviour, they warned.

Falling property and share values, along with the difficulty in getting credit also meant that consumers still faced “considerable headwinds”, they added.

However Fed members added that the chances of the US economy getting worse are “now considerably reduced” but that the recovery is “likely to be damped.”

Those concerns are likely the biggest reason why the Fed left its key interest rate near 0% at the meeting and did not announce any move to pull back on the more than 1 trillion US dollars it has pumped into the economy over the last year through various lending programs.

Central bankers echoed that optimism, saying in the minutes “that the incoming data and anecdotal evidence had strengthened... confidence that the downturn in economic activity was ending and that growth was likely to resume in the second half of the year.”

However the Fed said that consumer spending appeared to be levelling out and that the housing market was becoming more solid, while manufacturing was stabilising. The prospects for US exporters will also brighten, as the economies of other countries improved, the policymakers added. These factors led them to believe that “the downturn in economic activity was ending”, the minutes said.

But Fed members also added they were not sure when “credit conditions would normalize.”

The Fed's next policy meeting is a two-day session that will conclude on September 23. It is widely expected that the central bank will leave rates alone yet again.

Still, there appears to be some debate among Fed members about what to do next. While Fed policymakers have unanimously approved most major decisions over the past year, Fed members pointed to “a range of views, and considerable uncertainty, about the likely strength of the upturn” at the most recent meeting.

Since that meeting, President Obama nominated Federal Reserve chairman Ben Bernanke for a second four-year term as head of the central bank but the appointment needs the ratification of the Senate.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!