MercoPress. South Atlantic News Agency

Brazilian investment fund purchases Burger King targets Latam expansion

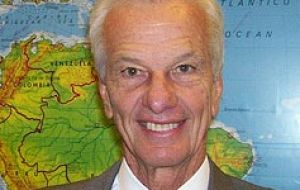

Jorge Paulo Lemann, ranks 48 in Forbes list of billionaires

Jorge Paulo Lemann, ranks 48 in Forbes list of billionaires Burger King (NYSE:BKC) announced that it has agreed to sell the company to an investment firm based out of Brazil in a deal valued at approximately 4 billion US dollars, which includes the assumption of debt.

The buyout marks the largest leveraged acquisition of a fast-food chain ever, and the second for Burger King in the last eight years.

The whopper-maker’s possible new owner, 3G Capital, is backed by a number of wealthy Brazilians, including billionaire and a former tennis champion who Warren E. Buffett refers to as a good friend.

3G plans to expand Burger King’s foothold internationally, especially in Latin America and Asia.

However, the fast-food chain has struggled in North America, where it generates 70% of its revenue. Just last week the company said it expects weak demand this year and also warned of wheat and beef prices and its possible effects on its bottom line.

Jorge Paulo Lemann, 71, ranks 48 in Forbes’s latest ranking of the world’s billionaires; he is estimated to be worth about 11 billion USD.

Lemann began to amass his fortune through the establishment of Banco de Investimentos Grantia, an investment bank that was sold to Credit Suisse for 675 million USD.

From banking, Mr Lemann moved into beer. Buying into the brewery that eventually became AmBev, his wealth grew when the business merged with European giant Interbrew in 2004 to create InBev. The company has since merged with US rival Anheuser Busch. Little is publicly known about Mr Lemann, other than that early in his life he was a top tennis player in his native country and is reported to have played at Wimbledon. He’s also used some of his fortune to promote the study of Brazil in America, donating 14 million to create the Lemann Institute for Brazilian Studies at the University of Illinois.

Mr Lemann isn’t the only Brazilian at 3G Capital: Alex Behring, who will become co-chairman of Burger King if the deal goes through, used to run one of the country’s biggest railroads.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!