MercoPress. South Atlantic News Agency

Venezuela inflation soars to 49%; Maduro promises more dollars to help with imports

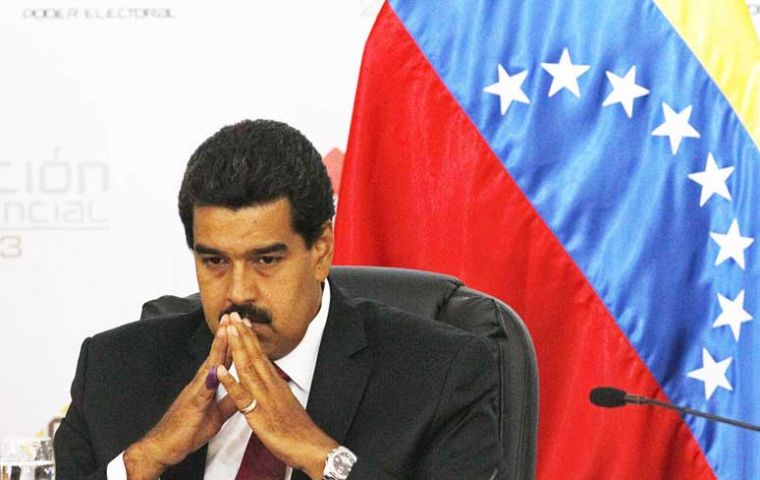

President Nicolas Maduro can’t contain promises or inflation

President Nicolas Maduro can’t contain promises or inflation Venezuela's annual inflation rate rose to 49.4% in September, from 45.4% in August. Consumer prices increased 4.4% month-on-month, the central bank said, compared with 3.0% in August. It was the highest annual rate since the Venezuelan government changed the formula used to calculate the figure five years ago.

President Nicolas Maduro's administration has vowed to rein in inflation this year and on Thursday pledged on national television to auction 900 million dollars a week to companies to help with imports and combat shortages.

The central bank said September's price rises were driven by a 9.7% spike for housing services, a 6.6% jump for alcohol and tobacco, and a 6.3% increase for education.

Shortages of products ranging from corn flour to toilet paper worsened slightly in September versus the previous month, with the bank's “shortage index” rising to 21.2% from 20%.

Central bank officials have indicated that given the new circumstances they will revise the year-end target of between 15% and 20% set last year.

Heavy state spending in 2012, which helped Maduro's predecessor Hugo Chavez win re-election last year, followed by a devaluation of the Bolivar currency in February, have fuelled inflation in the country of 30 million people.

The government blames inflation on unscrupulous merchants arbitrarily raising prices of staple goods and basic services and has called on youth brigades to help keep track of prices in supermarkets and stores.

Maduro said the government will sell to companies 900 million dollars a week through an auction system that charges buyers more than the official rate. The system is expected to last until the end of the year. Since July the government sold 761 million through auctions.

However the big question is whether this will be enough since the country buys 70% of its goods overseas. Shortages fuel inflation (almost 50%) and caused the Bolivar to lose 60% of its value against the dollar in the black market this year.

The dollars will “complement any need the economy may have” through the end of the year, Maduro said. He added the government is revising the entire system of foreign exchange controls. Venezuela’s international reserves have dropped to 22.1 billion dollars, the lowest level in almost nine years, according to private estimates.

Maduro said the government provides 95% of the dollars importers need at the official rate of 6.3 Bolivar. The remaining 5% is supplied through auctions in the so-called Sicad system at an undisclosed rate, he said.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsViva la revolucion! Viva el papel higienico!

Oct 11th, 2013 - 01:36 pm 0Take note Argentina, this is how bad it can get, and with worse still to come.

Oct 11th, 2013 - 02:43 pm 0I could never, ever imagined that Carlos Salinas, Bill Gates and Mike Bloomberg are individuals with more money in their pockets than the 5th oil exporter country of Venezuela.

Oct 11th, 2013 - 03:44 pm 0The speed of inflation in Venezuela is uncontrolled, because the temporary measures imposed by the government have no positive effect, to the contraty, local and internationl investment has decrease, while inflation quickly acelerates monthly.

Dolarization will be the only measure that will stop inflation, because the Central Bank of Venezuela will not be able to print any more currency bills as it is doing now, which in effect helps the encrease inflation rate.

If the country receives 85 Billions USD per year, why its inflation rate is 49%? If its monetary reserve is around 22 Billion USD and 70% of consumer goods are imported , that is including refinery goods, while loosing direct investment initiatives and incentives due to Bolivar's currency devaluation, and public and private credit operations are very limited, the question is; how long this ugly financial motion can continue?

Best and only option is Dolarization.

Kirk Nelson,

New York, USA

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!