MercoPress. South Atlantic News Agency

UK caught on the wrong side in a US/Beijing dispute over Chinese development bank

“There will be times when we take a different approach,” a spokesperson for Prime Minister David Cameron said about the rare rebuke from the US.

“There will be times when we take a different approach,” a spokesperson for Prime Minister David Cameron said about the rare rebuke from the US.  The AIIB, which was created in October by 21 countries, led by China, will fund Asian energy, transport and infrastructure projects.

The AIIB, which was created in October by 21 countries, led by China, will fund Asian energy, transport and infrastructure projects.  US sees the Chinese effort as a ploy to dilute US control of the banking system, and has persuaded regional allies such as Australia, South Korea and Japan to stay out of the bank.

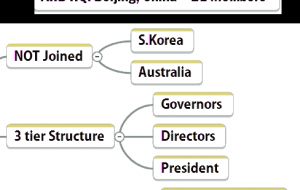

US sees the Chinese effort as a ploy to dilute US control of the banking system, and has persuaded regional allies such as Australia, South Korea and Japan to stay out of the bank. The US has expressed concern over the UK's bid to become a founding member of a Chinese-backed development bank. The UK is the first big Western economy to apply for membership of the Asian Infrastructure Investment Bank (AIIB) despite the fact that US has raised questions over the bank's commitment to international standards on governance.

“There will be times when we take a different approach,” a spokesperson for Prime Minister David Cameron said about the rare rebuke from the US.

The AIIB, which was created in October by 21 countries, led by China, will fund Asian energy, transport and infrastructure projects. The UK insisted it would demand the bank adhere to strict banking and oversight procedures. “We think that it's in the UK's national interest,” said PM Cameron's spokesperson.

Pippa Malmgren, a former economic advisor to US President George W Bush, told the BBC that the public chastisement from the US indicates the move might have come as a surprise.

“It's not normal for the United States to be publically scolding the British,” she said, adding that the US's focus on domestic affairs at the moment could have led to the oversight.

However, Cameron's spokesperson said UK Chancellor George Osborne did discuss the measure with his US counterpart before announcing the move.

In a statement announcing the UK's intention to join the bank, Osborne said that joining the AIIB at the founding stage would create “an unrivalled opportunity for the UK and Asia to invest and grow together”.

The hope is that investment in the bank will give British companies an opportunity to invest in the world's fastest growing markets.

But the US sees the Chinese effort as a ploy to dilute US control of the banking system, and has persuaded regional allies such as Australia, South Korea and Japan to stay out of the bank.

In response to the move, US National Security Council spokesman Patrick Ventrell said: “We believe any new multilateral institution should incorporate the high standards of the World Bank and the regional development banks.”

“Based on many discussions, we have concerns about whether the AIIB will meet these high standards, particularly related to governance, and environmental and social safeguards,” he added

Some 21 nations came together last year to sign a memorandum for the bank's establishment, including Singapore, India and Thailand. But in November last year, Australia's Prime Minister Tony Abbott offered lukewarm support to the AIIB and said its actions must be transparent.

US President Barack Obama, who met Mr Abbott on the sidelines of a Beijing summit last year, agreed the bank had to be transparent, accountable and truly multilateral.

“Those are the same rules by which the World Bank or IMF or Asian Development Bank or any other international institution needs to abide by,” Mr Obama said at the time.

The founding member countries of the AIIB have agreed the basic parameters that would determine the capital structure of the new bank would be relative gross domestic product.

Banking experts have estimated that, if taken at face value, this would give China a 67% shareholding in the new bank.

That's significantly different than the Asia Development Bank, which has a similar structure to the World Bank and has been in existence 1966. There, the majority stakes are controlled by Japan and the United States.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsWould have been better if US had kept its disapproval private.

Mar 16th, 2015 - 11:22 am 0the English are not of cedentas prostitutes for money. are now selling to China ... opportunistic sluts. hahahaha ....

Mar 16th, 2015 - 11:27 am 0Hahahaha.

Mar 16th, 2015 - 12:52 pm 0You have to laugh along otherwise you would cry.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!