MercoPress. South Atlantic News Agency

Holdouts request postponement of Argentina's proposal to solve dispute

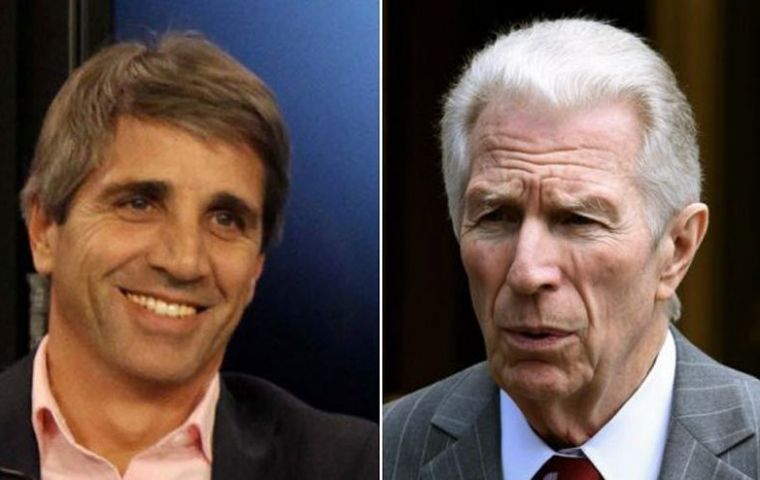

Caputo met in New York with mediator Pollack and holdout representatives and announced that on January 23, Argentina would present its proposal

Caputo met in New York with mediator Pollack and holdout representatives and announced that on January 23, Argentina would present its proposal  Following the meeting Caputo said he was 'satisfied' with this first meeting and underlined the Argentine government's predisposition to reach an understanding.

Following the meeting Caputo said he was 'satisfied' with this first meeting and underlined the Argentine government's predisposition to reach an understanding.  Treasury and Finance minister Alfonso Prat-Gay warned that the lack of an agreement with the holdouts had been “tremendously expensive for Argentina”

Treasury and Finance minister Alfonso Prat-Gay warned that the lack of an agreement with the holdouts had been “tremendously expensive for Argentina” Representatives from holdout investment funds have requested the Argentine government to postpone until the first week of February, next week's scheduled proposal to overcome the country's debt situation which remains technically in default.

The request was transmitted in a phone call by mediator Daniel Pollack to Luis Caputo, Argentina's Finance secretary, who is leading negotiations, reported the Treasury and Finance ministry.

“Last night in a phone call from mediator Dan Pollack, he informed me of the bond-holders request, because of logistics problems, to postpone the presentation of the Argentine proposal until the first week of February”, according to Caputo. The original date for the presentation was to be next Monday, 25 January.

The total sum in litigation is close to 10bn dollars, according to Argentine sources, following on Judge Thomas Griesa latest ruling which also included the so called 'me too'.

The release also points out that this week the Argentine government had sent out invitations to different leading international law firms, candidates to advise the Argentine government in the ongoing litigation. So far the representation of Argentina has been under the responsibility of Cleary Gottlieb Steen & Hamilton, which will become advisors of whatever firm is chosen to continue with the case.

Last week minister Caputo met in New York with mediator Pollack and representatives from the holdouts and announced that on the week beginning Monday 23 January, Argentina would be presenting its proposal to solve the litigation with United States justice over the holdout claims.

Caputo held meetings with the 'main holders' of non restructured bonds, and with representatives from the 'me too', which took place at Pollack's office in New York.

Following the meeting Caputo said he was 'satisfied' with this first meeting with representatives from the holdouts and underlined the Argentine government's predisposition to negotiate an understanding.

“If holdouts have the same intention and attitude, we should arrive to an agreement”, he was quoted by the Buenos Aires financial media.

That same day but in Buenos Aires, Treasury and Finance minister Alfonso Prat-Gay warned that the lack of an agreement with the holdouts had been “tremendously expensive for Argentina”, adding that in this new chapter of negotiations, which took off in New York, the Argentine government expects that creditors express “a similar responsibility to negotiate seriously”.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsThe postponement is a bit of a non- story.

Jan 21st, 2016 - 04:14 pm 0It sounds like both sides are willing to do actual negotiations and resolve the issues as quickly as possible.

Fresh ideas and attitude, from a new law firm sounds like good idea.

@1.

Jan 21st, 2016 - 06:12 pm 0The rottingroadkillians will pay when they are absolutely compelled to and not a day before. They have to then secure the terms and then obtain legislative approval authorizing the settlement. Then they have to find someone stupid enough to finance the settlement with another tranche of bonds which will have to be coauthorized by separate legislative mandate and all this as commodity futures - the underpinning of any underwriting analysis - are falling through the floor.

Keep your mouth shut and people will be.less likely to perceive the extent of your Canuck ignorance.

@2 I need a soft tissue printer

Jan 22nd, 2016 - 01:43 am 0I could then print out what you just wrote and wipe my ass with it.

Damm you seriously are a tool.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!