MercoPress. South Atlantic News Agency

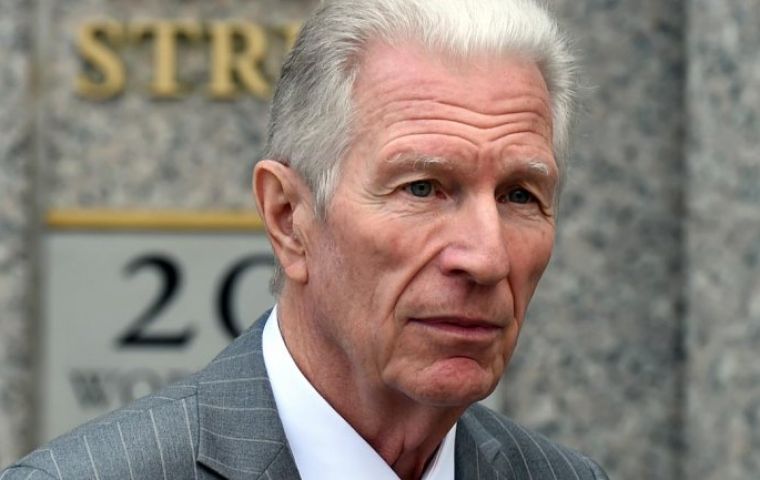

“Argentina will imminently be in default: no agreement was reached”, said Pollack

Special Master said default is not a mere “technical” condition, but rather a real and painful event that will hurt real people

Special Master said default is not a mere “technical” condition, but rather a real and painful event that will hurt real people “Unfortunately no agreement was reached and Argentina will imminently be in default”, admitted Daniel A. Pollack, the Special Master appointed by Judge Thomas P. Griesa to conduct and preside over settlement negotiations between Argentina and its holdout bondholders. Pollack emphasized that with default “the ordinary Argentine citizen will be the real and ultimate victim”.

In a release Pollack said that 30 July was the last day of the grace period for Argentina to pay hundreds of millions of dollars of interest to its exchange bondholders, those who accepted the 2005 and 2010 restructured bonds.

“Default is not a mere ”technical” condition, but rather a real and painful event that will hurt real people: these include all ordinary Argentine citizens, the exchange bondholders (who will not receive their interest ) and the holdouts ( who will not receive payment of the judgments they obtained in Court)“, added the Special Master who indicated that ”the full consequences of default are not predictable, but they certainly are not positive“.

After pointing out that the case has been highly publicized and highly politicized for many weeks, ”what has been perfectly clear to me all along, however, in my capacity as the neutral Special Master, is that the laws of the United States must be obeyed by all parties. The courts of the United States (both the United States District Court and the United States Court of Appeals), after full briefings and hearings, ruled that Argentina could not lawfully make the interest payments to the exchange bondholders unless it simultaneously made the payments due the holdouts“.

Finally, ”it is not my role or intent to find fault with either side. I will continue to be available to the parties to aid them in reaching a resolution which they must reach in the interests of all concerned“, since default cannot be allowed to lapse into a permanent condition.

Follows the complete statement:

”This morning and this afternoon, representatives of the Republic of Argentina, led by Minister of the Economy, Axel Kicillof, and representatives of its large bondholders held further face-to-face meetings in my office and in my presence.

Unfortunately, no agreement was reached and the Republic of Argentina will imminently be in Default. Today, July 30, was the last day of the grace period for the Republic of Argentina to pay many hundreds of millions of dollars of interest to its “exchange” bondholders, i.e. those who took bonds in 2005 and 2010 in exchange for the bonds they held following the Default of 2001. In order to make that payment of interest, however, the Republic of Argentina was also required, simultaneously, to make a “ratable” payment to the bondholders who declined to accept the exchanges of 2005 and 2010, i.e. the “holdouts”.

The Republic of Argentina did not meet those conditions and, as a result, will be in Default. Notwithstanding any claim to the contrary, Default is not a mere “technical” condition, but rather a real and painful event that will hurt real people: these include all ordinary Argentine citizens, the exchange bondholders (who will not receive their interest) and the holdouts (who will not receive payment of the judgments they obtained in Court).

The full consequences of Default are not predictable, but they certainly are not positive. This case has been highly publicized and highly politicized for many weeks. What has been perfectly clear to me all along, however, in my capacity as the neutral Special Master, is that the laws of the United States must be obeyed by all parties. The courts of the United States (both the United States District Court and the United States Court of Appeals), after full briefings and hearings, ruled that the Republic of Argentina could not lawfully make the interest payments to the exchange bondholders unless it simultaneously made the payments due the holdouts.

I have worked relentlessly, over a five-week period, to bring the Republic of Argentina and its bondholders together in an agreement that would allow the June 30 interest payment of many hundreds of millions of dollars to be made, and to be made lawfully, thereby avoiding Default. It is not my role or intent to find fault with either side. I will continue to be available to the parties to aid them in reaching a resolution which they must reach in the interests of all concerned. Default cannot be allowed to lapse into a permanent condition or the Republic of Argentina and the bondholders, both exchange and holdouts, will suffer increasingly grievous harm, and the ordinary Argentine citizen will be the real and ultimate victim.”

Top Comments

Disclaimer & comment rules-

-

-

Read all commentssad,but true

Jul 31st, 2014 - 01:26 am 0As I wrote earlier, when the debt burden becomes unsustainable, you refinance your house. In Marxism, there must not be such a thing as bankruptcy.

Jul 31st, 2014 - 01:34 am 0A sad end for a proud country. Machismo got the best of the woman, and every Argentine will suffer as a consequence of her vanity.

Jul 31st, 2014 - 01:43 am 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!