MercoPress. South Atlantic News Agency

Pollack announces a new settlement with Argentine bondholders

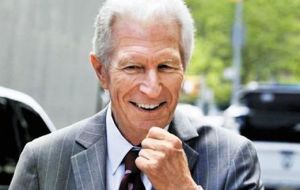

“I am very pleased to report that Argentina has reached an Agreement in Principle to settle the Brecher Class Action” said Special Master Daniel Pollack

“I am very pleased to report that Argentina has reached an Agreement in Principle to settle the Brecher Class Action” said Special Master Daniel Pollack The court-appointed mediator in the bonds dispute says Argentina has reached a settlement with bondholders seeking about 1% of the US$10 billion being pursued by investors. Mediator Daniel Pollack announced on Tuesday in New York the deal in the class action case. The deal came nearly two weeks after he announced two of six leading bondholders settled claims for more than US$1 billion.

The announcement comes as Argentina continues negotiating with multiple groups of bondholders who had refused years ago to trade bonds at a discount, going to court instead. Argentina had created the swaps after it defaulted in 2001 on approximately US$100 billion of debt.

Attorney Jason Zweig represents the latest settling bondholders. He says class bondholders had wanted about $28 million in unpaid principal plus interest. Individual bondholders must prove they continuously held their bonds.

The following is the statement from Daniel A. Pollack, Special Master presiding over settlement negotiations between Argentina and its Bondholders.

“I am very pleased to report that the Republic of Argentina has reached an Agreement in Principle to settle the Brecher Class Action, pending before Honorable Thomas P. Griesa. The exact size of the class will not be known for several weeks, but the settlement is on a ”claims made“ basis, which will require each potential class member to demonstrate to the Court that he or she has been a continuous holder of the Bonds from the outset of the litigation in 2006 through the present date.

”The settlement fits within the numerics of the Proposal publically issued by the Republic on February 5, and calls for payment of 100% of the principal and 50% of interest on the principal for each class member. The settlement is subject to two conditions: first, the approval by the Congress of Argentina, including the lifting of the Lock Law and the Sovereign Payment Law, and 2) the lifting of the Injunctions by Judge Griesa. As Special Master I am continuing to try to bring about settlements with other Bondholders, and am hopeful that there will be more settlements to come. I will have no further comment on this Agreement in Principle today“.

A spokeswoman for Argentina's Finance Ministry couldn't say how much the class action claims totaled. Last year, reports indicated the claims totaled around US$77 million.

”This means more holdouts are accepting our offer to settle the claims,“ the Finance secretary spokeswoman said. ”We hope everyone will eventually accept the offer. We would love for this to all be settled right away but that doesn't depend only on us.”

Earlier in February, Argentina reached a deal to settle claims with two other creditors, Dart Management and Montreux Partners. It is still in talks with several other big creditors, including Aurelius Capital Management and Paul Singer's Elliott Capital Management.

Argentine President Mauricio Macri, who took office last December, has made settling the dispute, which has dragged on now for 15 years, a top priority.

The conflict is critical to Argentina because it is preventing the country from tapping credit markets to obtain badly needed dollars.

Argentina recently asked the judge overseeing the case, U.S. District Judge Thomas Griesa, to overturn an injunction that is preventing it from selling bonds abroad. Judge Griesa has given the creditors until Thursday to explain why he shouldn't lift the injunction. On request from Griesa approved a request by NML Capital and Aurelius to take the deadline to February 19, originally set for February 18.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsSeems like progress.

Feb 17th, 2016 - 12:22 pm 0Friday will be interesting!

Singer loses his grip each time a bondholder settles.

Feb 17th, 2016 - 01:02 pm 0He is looking more and more like the greasy pig he is.

@2. NML Capital and Aurelius prove why and how argieland is attempting to evade thye court judgments. Injunction remains.

Feb 17th, 2016 - 01:43 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!