MercoPress. South Atlantic News Agency

Investments

-

Monday, January 2nd 2017 - 12:21 UTC

China pledges to boost investment in tourism and promises “toilet revolution”

China said it will boost investment in tourism, with plans to develop rustbelt regions and upgrade public toilets high on its to-do list as it looks to lift the sector's contribution to economic growth.

-

Thursday, December 29th 2016 - 06:07 UTC

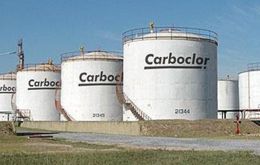

ANCAP company in Argentina seeks bankruptcy reorganization proceedings

Uruguayan oil company ANCAP announced Wednesday through a press release that one of its companies, Carboclor S.A., based in Argentina, had turned to the courts to start the reorganization proceedings, known in Argentinian law as “Concurso Preventivo,” which is very similar to the United States' “Chapter Eleven” bankruptcy mechanism.

-

Tuesday, December 27th 2016 - 09:17 UTC

Petrobras plans to claim part of Odebrecht's payments deal in US and Switzerland

![“We’re looking for ways to reimburse shareholders and the [Brazilian] government,” said Petrobras’s governance director João Elek](/data/cache/noticias/57902/260x165/joaoelek.jpg)

Brazilian oil company Petrobras plans to request part of the record anticorruption settlement that construction company Odebrecht SA signed earlier this week with Brazilian, U.S. and Swiss authorities. Petrobras has said it was the victim of the vast bid-rigging and kickbacks scheme that Odebrecht admitted to helping run.

-

Tuesday, December 27th 2016 - 09:03 UTC

Deutsche Bank and Credit Suisse reach payment deals with US authorities on sub-prime scams

Germany's Deutsche Bank announced it has agreed a US$7.2bn payment to US authorities over an investigation into mortgage-backed securities. The sum, which needs final approval, is far lower than the US$14bn the US had asked the bank to pay in September. The looming fine had caused concerns that a failure of the bank could pose a risk to the global financial system.

-

Monday, December 26th 2016 - 14:33 UTC

Falklands government secures environmental planning contract with Aedis

The Falkland Islands Government have secured the services of Tees Valley based building control firm Aedis. The contract will see Aedis delivering a raft of professional consultancy services based upon their building control expertise. This includes providing a remote plan checking service to help the Falkland Islands Environmental Planning Department ensure all new building work complies with the necessary building regulations.

-

Tuesday, December 20th 2016 - 08:57 UTC

Brazil's Vale sells its fertilizer business to cut debt

Brazil's Vale, the world’s largest iron ore and nickel miner said on Monday it will sell most of its fertilizer business to US-based Mosaic Co., the No.1 producer of phosphate fertilizer, in a deal worth about US$2.5 billion.

-

Saturday, December 17th 2016 - 00:24 UTC

Petrobras sells ethanol assets as it moves out of the biofuels industry

Brazil's oil company Petrobras has agreed to sell its 49% stake in the sugar and ethanol joint venture Nova Fronteira Bioenergia SA to partner São Martinho SA, both companies said in securities filings on Thursday. Petrobras will receive 24 million new São Martinho shares as payment for the stake. Petrobras said in the filing that it will attribute a US$133 million value to the deal.

-

Thursday, December 15th 2016 - 00:18 UTC

Fed raises rate 25 points to 0.75%, anticipates further increases while US dollar jumps in Asian markets

The U.S. Federal Reserve increased its benchmark interest rate by a quarter of a percentage point to a range of between 0.5 and 0.75%. The higher rate will affect the what savers and borrowers get on their variable rate products from banks, and the fine print of the bank's policy decision shows that a majority of Fed members expect more rate hikes to come, as many as three in the next 12 months, after previously signaling it was expecting only two.

-

Tuesday, December 13th 2016 - 08:49 UTC

First loan for an Andes tunnel to connect Argentina with Chile as part of Mercosur road net

The Inter-American Development Bank (IDB) has approved a US$40 million loan that will allow for bidding to begin for the Agua Negra tunnel, which will connect San Juan province in Argentina with that of Coquimbo in Chile. The tunnel is key to improving trade integration between the two countries and the rest of Mercosur through a new corridor that will connect the Atlantic and the Pacific from Porto Alegre, Brazil, west to Coquimbo, Chile.

-

Tuesday, December 13th 2016 - 07:51 UTC

Another Goldman Sachs/Wall Street top official named to Trump's economic team

Gary Cohn who was tapped Monday by President-elect Donald Trump to head the Gary Cohn , is second-in-command at investment banking giant Goldman Sachs, which he once hoped to lead. Cohn, 56, has worked on Wall Street since the 1990s and is one the firm’s best known public faces. He makes frequent television appearances to talk about the health of financial markets and the global economy.