MercoPress. South Atlantic News Agency

Greenspan's toning down of forecast could calm volatility

“World economy will return to a more normal in a couple of years” said Greenspan

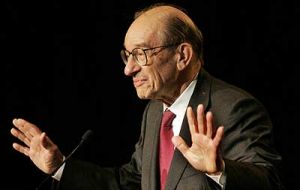

“World economy will return to a more normal in a couple of years” said Greenspan Toning down his earlier warning over a recession in the United States later this year, former U.S. Federal Reserve Chairman Alan Greenspan told a Tokyo seminar Thursday that he does not think economic slowdown in the US is “probable”.

"It is possible we can get a U.S. recession toward the end of this year, but I don't think it's probable" Greenspan was quoted in his speech at a Tokyo forum organized by international brokerage CLSA. On Monday he told an audience in Hong Kong that he couldn't rule out a recession this year in part because slowing growth in profit margins suggests the expansion might be winding down, a comment blamed in part for the current global stock markets decline. A plunge in Chinese share prices Tuesday and weaker-than-expected U.S. durable goods orders for January were also seen as contributing to the world's shares market slump. Speaking via satellite to investors at CLSA's Japan Forum, Greenspan appeared to want to hedge his bets on his prediction of the U.S. economy although earlier in the week he acknowledged that most economists don't foresee a recession. "Things look reasonably good in the short run for the U.S. and the world," he said. But "we can't just assume that this extraordinary period of recovery can extend indefinitely" Current low yield premiums aren't sustainable, profit margins are peaking and the U.S. growth cycle is in a mature phase, Greenspan was quoted in Tokyo. "Previous experience suggests a flattening of profit margins should produce a recession, but the globalization of the economy may mean that pattern may not be repeated this time", said the former Fed chairman. Greenspan said that the U.S. has "gone through the major part of adjustment" in housing prices and "the worst is over," though the housing market is expected to remain weak according to CLSA. He said the weak U.S. housing market has had only limited impact on consumer spending because consumers have been encouraged by the fall in gasoline prices. The global economy is in a long-term trend of disinflation and low interest rates, mainly because of the emergence of some economies from central planning, such as Eastern Europe and China, according to CLSA. Because the global economy now includes countries and regions that have highly skilled but less expensive labor, the cost of goods has declined. That's allowed real and nominal interest rates to decline, he said. Greenspan predicted that in two or three years, this disinflation process will probably come to an end and the world economy will return to a more normal era of price-pressure increases. The asset category most affected by that will be low-quality debt, the former Fed chairman said. More specifically on the current evolution of world markets Greenspan said that the relative mildness of this week's equity-market declines is evidence that financial systems have become better at accommodating shocks. On Wednesday the current Fed Chairman Ben S. Bernanke told US Congress that the central bank still expects the economy to pick up later this year, but admitted that the lower than expected US economy expansion in the last quarter of 2006, 2.2%, down from a previous estimate of 3.5%, also contributed to the global slump of markets.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!