MercoPress. South Atlantic News Agency

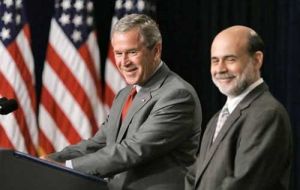

Bernanke and Bush: no interest rate cuts to bail out investors

Pte. Bush and Bernanke “no clear signal that the Fed is poised to cut interest rates”

Pte. Bush and Bernanke “no clear signal that the Fed is poised to cut interest rates” Chairman Ben Bernanke offered no clear signal that the Federal Reserve is poised to cut interest rates in a speech to central bankers on Friday, even as he reaffirmed its commitment to take into account the likely effects of financial market turmoil on the economy.

The Fed chairman made it clear that there would be no rate cuts simply to bail out investors, declaring "it is not the responsibility of the Federal Reserve – nor would it be appropriate – to protect lenders and investors from the consequences of their financial decisions". But he also said that developments in financial markets "can have broad economic effects felt by many outside the markets, and the Federal Reserve must take those effects into account". The tone of the Fed chairman remarks at the annual retreat in Wyoming, suggested that the US central bank remains undecided about the likely future path of interest rates. This stands in contrast to the apparently high degree of certainty in the markets that the Fed will soon embark on a series of rate cuts. Bernanke's remarks came as President George W. Bush announced measures to help struggling US homeowners refinance mortgages through an expansion of the Federal Housing Administration and changes to the tax code. But he insisted there would be no government bail-out to solve the subprime mortgage crisis. "The government's got a role to play. But it is limited. A federal bailout of lenders would only encourage a recurrence of the problem" said Mr Bush. In his speech Bernanke said recent economic data suggested that the economy grew at a "moderate pace" into the summer, but said that in the light of recent financial market developments, this data may not be a good guide to future economic performance. Mr Bernanke said the stock of unsold new homes in the US remains "quite elevated" and further declines in homebuilding are "likely", adding that the Fed was "following closely" developments in financial markets that could put further pressure on the housing market. The Fed chairman said "financial stress" has "not been confined to mortgage markets" pointing out that "global financial losses have far exceeded even the most pessimistic projections of credit losses" on sub-prime loans. Bernanke said the sub-prime mortgage crisis was in large part the result of the "failure of investors to provide adequate oversight of originators and to ensure that originators incentives were properly aligned." The Fed will meet to set rates on 18 September amid growing speculation that it will cut the cost of borrowing to ease the current liquidity problems in the financial markets. The Fed has so far released billions of dollars of emergency funds into the financial system in an attempt to ease fears over the lack of available credit. It has also cut the interest rate at which it lends to banks.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!