MercoPress. South Atlantic News Agency

Bad-news inflation as US economy sharp slowdown confirmed

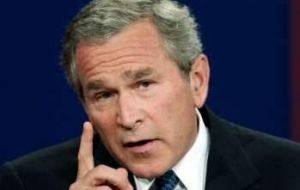

Bush: “concerned about the economy”

Bush: “concerned about the economy” United States economic growth fell sharply in the last three months of 2007 as the credit crunch took effect and spending on new housing slumped, revised figures released Thursday show.

Speaking at the White House President George Bush insisted the US economy was heading for a slowdown, not a recession, but rejected the call for a second stimulus package. In the meantime the oil barrel reached for a second day running a new peak of 102.08 dollars for the US sweet crude, before closing just below 100, while the US dollar plunged further reaching 1.52 to the Euro. Updated figures from the US Department of Commerce showed the economy grew at an annual rate of just 0.6% in the quarter, as predicted last month. The data follows a quarter of brisk growth, as between July and September the US grew at an annual pace of 4.9%. GDP grew by 2.2% for all of 2007, the slowest rate since 2002. But investment in real estate fell at an annualized pace of 25.2% in the fourth quarter, the biggest fall since 1981. The latest figures come a day after US Federal Reserve chief Ben Bernanke hinted the central bank was prepared to cut interest rates further to help ease recession fears. In his semi-annual report to the US Congress, Mr Bernanke said the Fed would continue to "act in a timely manner as needed to support growth". Analysts said his comments increased the likelihood of another rate cut at the Fed's next meeting on 18 March. US interest rates are currently at 3% after two major reductions. In the White House President Bush said he was concerned about the economy because he cared about "working Americans" while outlining the timetable for a package of measures aimed at stimulating the economy by encouraging consumers to increase spending. Bush's comments come a day after Federal Reserve chairman Ben Bernanke hinted at further interest rate cuts after describing US economic conditions as "distinctly less favorable" and could get worse. Last month Congress passed a 150 billion US dollars stimulus package which will mean millions of Americans receive tax rebates ranging from 300 to 1.200 dollars. However he rejected calls for a second package of measures, telling reporters at the White House press conference: "why don't we let the stimulus package we have a chance to kick in". Democrats in Congress are trying to pass additional measures to provide aid to those homeowners facing foreclosure on their mortgages as a result of the sub-prime crisis. Meanwhile the price of oil climbed to 102.08 US dollars a barrel as traders switched their cash out of shares and currencies into commodities. However the International Energy Agency said the figure is still surpassed in inflation-adjusted terms by the peak of 102.53 reached in 1980. Investors are pumping cash into commodities and metals, which look a safer bet because of continued high demand in Asia to feed the region's industrial boom.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!