MercoPress. South Atlantic News Agency

Fed rate unchanged; injects 70 billion to boost liquidity

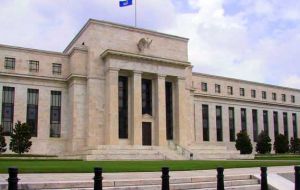

Federal Reserve building

Federal Reserve building The United States Federal Reserve left interest rates unchanged at 2% on Tuesday arguing slower economic growth but also warning about an inflation outlook “highly uncertain”.

However the Federal Reserve injected 70 billion US dollars into markets to boost liquidity following the collapse of Lehman Brothers and its repercussions in global markets. In its release the Federal Open Market Committee, FOMC, said "inflation has been high, spurred by the earlier increases in the prices of energy and some other commodities. The Committee expects inflation to moderate later this year and next year, but the inflation outlook remains highly uncertain". Nevertheless the "downside risks to growth and the upside risks to inflation are both of significant concern to the Committee. The Committee will monitor economic and financial developments carefully and will act as needed to promote sustainable economic growth and price stability". On describing the situation FOMC said that strains in financial markets have increased significantly and labor markets have weakened further while "economic growth appears to have slowed recently, partly reflecting a softening of household spending". In the next few quarters "tight credit conditions, the ongoing housing contraction, and some slowing in export growth are likely to weigh on economic growth", but over time, "the substantial easing of monetary policy, combined with ongoing measures to foster market liquidity, should help to promote moderate economic growth". The decision to leave rates at 2%, as it has been since April, was a unanimous move. Following the Fed news, US shares were volatile with the leading Dow Jones Industrial Average down 106 points to 10,811. However it later ended more than 140 points higher at 11,059.02 as investors interpreted the Fed's decision as a sign that the economy was less fragile than some had feared. Another factor boosting the market was reports that insurance giant AIG might be able to access a loan from the Federal Reserve, which would prevent the firm from collapsing. Investment firm Lehman Brothers filed for bankruptcy on Monday, triggering market jitters and prompting a sharp fall in shares worldwide. Fears have been rising that AIG could be the next firm to fold.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!