MercoPress. South Atlantic News Agency

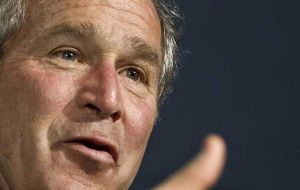

Bush: “unprecedented measures” to de-intoxicate system

Bush asks Congress for $700 billion for bailout

Bush asks Congress for $700 billion for bailout United States is set to take “unprecedented measures” to tackle the crisis gripping US financial markets, announced President George Bush on Friday. But he warned the moves, which include spending of billions of dollars to buy up bad debts, would risk “a significant amount” of taxpayers' money.

Legislation for the plan will be pushed through as soon as possible, Treasury Secretary Henry Paulson said. The US took action after a week of turmoil on global money markets. Stock markets around the world have endured a roller-coaster week as traders and investors fretted about the fall-out from the current credit crisis: * Central banks around the world pumping billions of dollars of extra funding into money markets on Thursday and Friday to ease the liquidity crisis - The US announcing further measures to shore up the markets, including a ban on short-selling and guarantees to temporarily insure money market deposits - Stock markets around the world rallying after a dire week on news of the US rescue plans - with the UK's FTSE 100 closing with its biggest one-day gain - Stock markets in Russia temporarily suspended again on Friday at the end of a week of wild swings and stop-go trading - Banking group Morgan Stanley reportedly looking for a partner amid concerns about its future President Bush said swift, politically bipartisan action was needed to keep the US economy from grinding to a halt as problems sparked by the credit crisis had begun to spread through the entire financial system - leaving jobs, pensions and companies under threat. "These are risks the US cannot afford to take. We must act now to protect economic health from serious risk," he added. The US is facing "unprecedented challenges and we're responding with unprecedented action", he said. A "bold" move was needed to restore the financial system's health, Mr Paulson insisted. He added the Bush administration was stepping in with a plan to remove so-called "toxic debts" from US banks' balance sheets. While he gave few details, he said federal lawmakers would meet over the weekend to thrash out legislation for the programme which must be "large enough to have maximum impact". In the meantime, he said that the government would be stepping up action to increase the availability of capital for new home loans. Once this difficult period was over, Mr Paulson said, the government's next task would be to overhaul bank regulations. The chairman of the Senate Banking Committee, Christopher Dodd, said he and his colleagues would need to see the details of the plan first, but he accepted that quick action would be needed. "We understand the gravity of the moment," said the Democratic senator. Earlier in the day, the government announced plans to guarantee US money market funds - mutual funds that typically invest in low-risk credit such as government bonds and are often used by pension funds - up to a value of 50 billion US dollars, in a move to further restore confidence. Meanwhile, the Securities and Exchange Commission temporarily banned "short-selling" in the stocks of 799 companies. Short-selling is a form of trading which effectively bets that the value of a company's shares will fall. Reaction to the announcements was swift on money markets across the world, with Wall Street closing in positive territory while the London market ended the session with its biggest one day gain. "The Treasury and the Fed have finally realiszd the depth and systemic nature of the crisis," said John Ryding, an economist at RDQ Economics "We believe that these actions will constitute the wider firebreak that will contain the crisis." However, the proposals did draw criticism from Republican presidential nominee John McCain. "The Federal Reserve should get back to its core business of responsibly managing our money supply and inflation," he told reporters. Meanwhile, Democratic rival Barack Obama gave his backing to plans to give the Treasury department "broad authority" to deal with the crisis. According to President Bush action will restore confidence to the US system, and "confidence is essential to the smooth operation of our economy". Mounting fears that the credit crisis is beginning to spread out through the financial system have rocked shares and companies recently. Investment giant Lehman Brothers collapsed this week, rival Merrill Lynch was bought out by Bank of America, and the US government has bailed out insurer AIG with an 85 billion US dollars rescue package and state-backed mortgage lenders Fannie Mae and Freddie Mac.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!