MercoPress. South Atlantic News Agency

Stiglitz says bailout plan is “monstrous” for US taxpayers

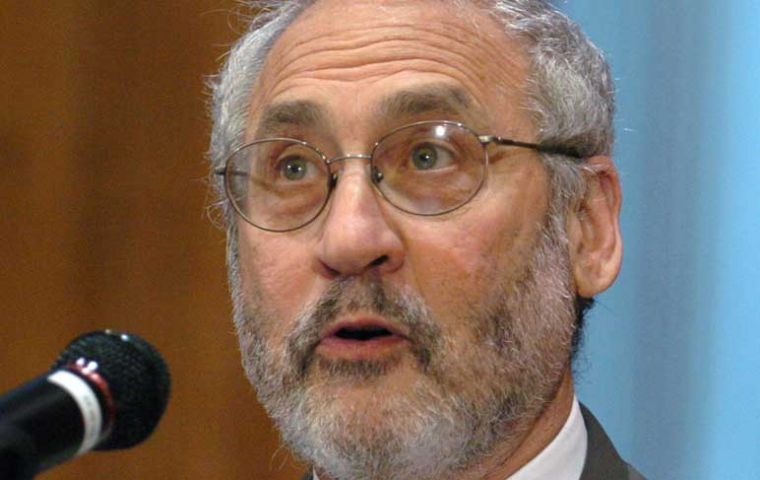

Economist Joseph Stiglitz

Economist Joseph Stiglitz Economy Nobel Prize Joseph Stiglitz described as “monstrous” for US taxpayers the current bail out plan for the financial sector announced by Washington over the weekend.

"This plan is nothing else but a short term solution", said Stiglitz in a Sunday interview with Germany's Frankfurter Allgemeine Sonntagszeitung (FAS). "We're turning risk investment funds into the hands of taxpayers", he added pointing out that since no private investor wants to take responsibility for "risk investments, we're simply wall papering them on to the taxpayer, this is monstrous". According to Stiglitz the current crisis marks the end of a "disastrous economic model" and the end of the ideology "by which free and deregulated markets always function". As a consequence of the current situation the US financial system as well as the US government "has lost all credibility". Stiglitz argues that to rescue the system and bring stability to markets, the US government is planning to buy from banks and financial institutions all "non liquid" assets who nobody wants and were the origin of the one of the greatest and deepest crisis ever faced by Wall Street and the US economy, the Great Depression of 1929. For this the President Bush administration has requested from Congress 700 billion US dollars for a special fund to purchase these assets and bring stability to financial markets. However private estimates believe the final bill could be well above the trillion US dollars. But according to Stiglitz who is currently professor at the Columbia University in New York the proposal will not help solve the problem: "there's every chance that other banks could also be affected". Stiglitz has long established that the rout of the current situation is the sub prime housing problem and it is there where assistance must be geared. "This is only the beginning of the crisis" and according to his predictions the US is in the brink of a prolonged recession. The solution is not bailing banks eliminating "toxic" debts but rather helping home owners renegotiate conditions of their mortgages. However US public opinion seems to be split in half regarding the rescue plan announced by Treasury Secretary Hank Paulson and currently under discussion in the US Congress. A poll from Zogby International shows that 46% support for the package and a similar percentage against it, with 8% undecided. But opinions coincide regarding the depth and extent of the crisis: 70% see it as a long term threat and only 24% believe it's a short term situation. An overwhelming majority, 84% are convinced that it's only a matter of time before other investment banks and some of the US main financial institutions collapse in the coming months. The Zogby opinion poll has a plus/minus 2.1 percentage points error. In spite of the urgency requests from President Bush and Secretary Paulson, Congress is tanking its time and the opposition Democrats insist in including aid for families affected by housing foreclosures. Democrat presidential candidate Barack Obama in a political rally in North Carolina said on Monday that the package must include clauses to protect taxpayers' money and a commitment to reform the financial markets regulatory system.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!