MercoPress. South Atlantic News Agency

California is asking 7 billion USD from Uncle “Hank” Paulson

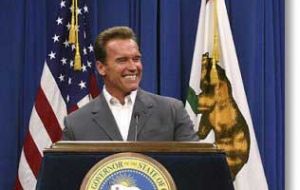

'Terminator' Schwarzenegger is one of many USA Governors short of money

'Terminator' Schwarzenegger is one of many USA Governors short of money California is the latest US state to be feeling economic shockwaves from the financial crisis on Wall Street in the form of budget deficits, dwindling finances and plummeting pension funds.

Governor Arnold Schwarzenegger said that the state may need an emergency loan of up to 7 billion US dollars from the federal government within weeks just to maintain day-to-day operations in a letter e-mailed to US Treasury Secretary Henry "Hank" Paulson. Without the loan, the governor warned that the state "may be unable to obtain the necessary level of financing to maintain government operations." Schwarzenegger added that many states and local governments have been unable to get financing for "routine cash flow used to make critical payments to schools, local governments and law enforcement." Schwarzenegger, whose staff followed up the letter with a call to Paulson, also expressed his strong support for the 700 billion USD financial industry bailout plan that the US House of Representatives passed on Friday. The emergency loan, which would be the largest ever given to the state, would mark only the second time that the federal government has pulled off such a rescue operation, according to finance experts. In 1975, the government lent money to New York City, which was teetering on the edge of bankruptcy. "California does need to borrow a lot of money in a short amount of time," says Mark Baldessare, president of the Public Policy Institute of California. "I would think it's unprecedented. California is not in danger of going bankrupt, but the problem is the cash flow." With credit markets ever so tight earlier this week Massachusetts was unable to borrow the final portion of a 400 million USD loan from Wall Street investors to make quarterly aid payments to cities and towns and had to dip into its own funds to make up the 170 million shortfall. Connecticut Governor Jodi Rell announced 35 million USD in budget cuts, the second round of such cutbacks, to reduce a projected state budget deficit of more than 300 million. In Virginia, Governr Timothy M. Kaine is examining spending cuts of 5, 10 and 15% to every state agency, including the state police. In New York state layoffs in the financial sector could really hurt tax collection since according to estimates Wall Street workers account for 20% of the state's income tax revenues.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!