MercoPress. South Atlantic News Agency

Uruguay de-listed from group of non cooperative tax havens

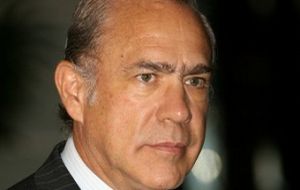

Gurria congratulates Uruguay for accepting OECD guidelines

Gurria congratulates Uruguay for accepting OECD guidelines The Organization for Economic Cooperation and Development, (OECD) welcomed on Thursday the formal endorsement by Uruguay of its tax information exchange standards.

In a letter to Angel Gurría, Secretary-General of the OECD, Uruguay’s Finance Minister, Alvaro García, informed the OECD that Uruguay formally endorses the OECD’s standards on transparency and exchange of information, as set out in the 2005 version of Article 26 of the OECD Model Tax Convention.

He confirmed that Uruguay is incorporating this standard in the treaties it is currently negotiating and in future agreements. Uruguay expects to submit one or more of these agreements for ratification later this year.

“I am pleased that Uruguay joins a growing number of nations willing to co-operate in fighting tax evasion and other tax abuses,” said Gurría.

In Montevideo Minister Fernandez said that Uruguay “never was, is or will be a tax haven” and underlined that it’s the only known case of a country “listed and de-listed in less that 48 hours”.

On Thursday the London G20 summit pledged to take action including sanctions against non-cooperative jurisdictions, including tax havens, using information from the OECD as its basis. The non-cooperative centres are accused of harbouring foreign tax avoiders who park billions of dollars out of reach of their home authorities.

The OECD Secretariat report on progress by financial centres around the world towards implementation of an internationally agreed standard on exchange of information for tax purposes had Uruguay, Costa Rica, Malaysia and the Philippines on its blacklist of non-cooperative tax havens.

“We have agreed that there will be an end to tax havens that do not transfer information upon request,” said British Prime Minister Gordon Brown at the end of the G20 summit. “The banking secrecy of the past must come to an end,” he added.

“Recent developments reinforce the status of the OECD standard as the international benchmark and represent significant steps towards a level playing field,” said OECD Secretary-General Angel Gurria in comments published on the OECD website.

“We now have an ambitious agenda, that the OECD is well placed to deliver on,” he added. “I am confident that we can turn these new commitments into concrete actions to strengthen the integrity and transparency of the financial system.”

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!