MercoPress. South Atlantic News Agency

BRIC members meet to demand greater voice is world financial affairs

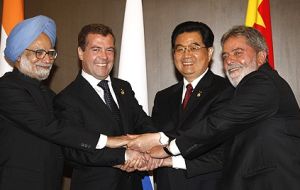

The four leaders shake hands

The four leaders shake hands The world's newest economic grouping, BRIC is to hold its first summit in the Russian city of Yekaterinburg beginning Tuesday. BRIC is named after its four member states - emerging giants Brazil, Russia, India and China; they account for 13% of global GDP and 40% of world population.

They are expected to put efforts to improve the global economy and reforming international financial institutions at the top of the agenda. The group is battling to force the West to give greater recognition to the developing giants.

China is now the world's third biggest economy, while Russia, India and Brazil are catching up with many key European economies.

The term BRIC was coined by US investment bank Goldman Sachs which used it to describe the growing power of emerging market economies in 2001. The research suggested the four developing economies could be among the strongest in the world by 2050.

The meeting in Yekaterinburg, a city some 1,420km east of Moscow, includes Russia’s Dmitry Medvedev; Hu Jintao of China; Lula da Silva of Brazil and Indian Prime Minister Manmohan Singh.

Analysts say that as the global recession bites, the four BRIC nations are showing a growing willingness to work together.

Rory MacFarquhar, a Moscow-based economist at Goldman Sachs, said the significance of the summit would be political rather than economic.

”There is considerable interest, you could say from all (the BRIC) countries but Russia in particular, in creating an alternative” to established international organisations.

Both Russia and China have questioned the role of the dollar in the world's economy, leading to speculation that BRIC might be considering the creation of a new global reserve currency. Brazil has also expressed a cautious concern about the US currency although India remains less active on this front.

China's central bank governor caused a stir in March when he said the US dollar should be replaced as the world's largest reserve currency by the Special Drawing Right (SDR) - a unit of account issued by the International Monetary Fund.

And Russian President Dmitry Medvedev said at the beginning of this month that the idea of a “supranational currency” should be discussed at the BRIC summit.

These concerns have in part led to a decline in the dollar against other major currencies in recent months and sent jitters through the market for US government debt.

However, on Sunday a Kremlin spokesman said that would not be on the agenda.

Russian Finance Minister Alexei Kudrin said Tuesday's meeting would focus more on ways to reform international financial institutions.

This had an immediate impact and on Monday with the US dollar rebounding in money markets. Mr. Kudrin explicitly said the greenback would not be replaced as the world's reserve currency in the near future and China's vice foreign minister Ha Yafei has assured the US that “nobody is talking about dumping the US dollar”.

The fact remains that China and Russia are two of the world's biggest holders of US dollar assets and steps that the US is taking to boost its economy and help it recover from the financial crisis could undermine the value of the US currency.

China and Russia have already taken some small steps to diversify their currency reserves away from the dollar: China has made arrangements with six countries worth 650bn Yuan (95billion US dollars) that allow trade to be conducted in Yuan rather than dollars; China and Russia have said they will buy bonds to be issued by the IMF and data released on Monday showed that both China and Russia had trimmed their holdings of US government bonds in April.

But analysts say the BRIC countries are unlikely to mount a real challenge to the dollar's supremacy. Any concrete suggestion of a wholesale switch away from the dollar would dramatically undermine the value of their reserves.

The US has also reacted to these concerns and Treasury Secretary Timothy Geithner visited China at the end of May to give assurance over the safety of dollar assets, and met with his Russian counterpart over the weekend at the sidelines of the G8 finance ministers meeting.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!