MercoPress. South Atlantic News Agency

ECB says recession is “bottoming out” and predicts positive growth in 2010

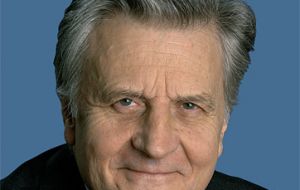

Trichet warned about volatility stemming from renewed increases in oil and commodities, protectionism and disorderly correction of global imbalances.

Trichet warned about volatility stemming from renewed increases in oil and commodities, protectionism and disorderly correction of global imbalances. The European Central Bank (ECB) has said on Thursday it expects to see growth returning to the global economy next year as it kept interest rates on hold at 1%. However economic activity is likely to remain weak this year.

But while the outlook was uncertain, it said that there were signs the recession was “bottoming out” and that “positive growth” would return in 2010.

“There are increasingly signs that the global recession is bottoming out. As regards the Euro area, recent surveys suggest that the pace of contraction is clearly slowing down. However, economic activity over the remainder of this year is expected to remain weak. Looking ahead into next year, after a phase of stabilization, a gradual recovery with positive quarterly growth rates is expected and the significant policy stimuli in all major economic areas should support growth globally, including in the Euro area”, said Trichet in his statement.

The ECB last cut rates in May, when they were reduced to 1% from 1.25%. It has reduced rates seven times since last October, when rates stood at 4.25%.

As part of efforts to boost business lending and spur economic growth, the central bank has also supplied cash to the banking system and previously pledged to buy 60 billion Euros of low-risk corporate bonds.

The ECB's vice president Lucas Papademos described the program to buy bonds as “very successful”.

Trichet also cautioned about volatility although overall “the risks to this outlook remain balanced. On the upside, there may be stronger than anticipated effects stemming from the extensive macroeconomic stimulus being provided and from other policy measures taken. Confidence may also improve more quickly than currently expected”.

On the downside, “concerns remain relating to a stronger or more protracted negative feedback loop between the real economy and the turmoil in financial markets, renewed increases in oil and other commodity prices, the intensification of protectionist pressures, more unfavorable than expected labor market conditions and, lastly, adverse developments in the world economy stemming from a disorderly correction of global imbalances”.

With regard to price developments ECB president said that the further decline in annual rates (-0.6% in July compared with –0.1% in June) “was anticipated and reflects primarily base effects resulting from the peaks observed in global commodity prices a year ago”.

But looking ahead: “inflation is expected to remain in positive territory while price and cost developments are expected to remain subdued in the wake of ongoing sluggish demand in the Euro area and elsewhere. In this respect, indicators of inflation expectations over the medium to longer term remain firmly anchored in line with the Governing Council’s aim of keeping inflation rates below, but close to, 2% over the medium term”.

Finally Trichet said that the flow of bank loans to the non financial private sector remained subdued in June and called on banks to take full advantage of government measures to support the financial sector, particularly recapitalization.

“The flow of loans to non-financial corporations turned substantially more negative owing to a sharp contraction in short-term lending. At the same time, the flow of loans to households was slightly more positive than last month. The ongoing uncertainty seems to have dampened borrowers’ demand for financing”

“Given the challenges that lie ahead, banks should take appropriate measures to strengthen further their capital bases and, where necessary, take full advantage of government measures to support the financial sector, particularly as regards recapitalization”.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!