MercoPress. South Atlantic News Agency

UK leading banks accept international-agreed curbs on bonuses

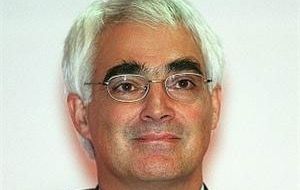

Chancellor Alistair Darling welcomed the decision

Chancellor Alistair Darling welcomed the decision Britain's five biggest banks have signed up to new internationally-agreed curbs on bonuses, it has been announced. Chancellor Alistair Darling welcomed the decision by the banks to accept the principles agreed last week at the G20 summit in Pittsburgh.

The five - HSBC, Barclays, Lloyds, RBS, and Standard Chartered - have committed to implement the new rules, intended to link bonuses to long-term performance, on payments for 2009.

Under the terms of the Pittsburgh agreement, up to 60% of bonus pay-outs will be deferred over three years, with arrangements to claw back payments from staff who fail to perform. The banks will also be required to publish annual reports on their pay and bonuses, including information on the linkage with performance.

In a joint statement, released through the Treasury, the banks said they were committed to working with the Financial Services Authority on the implementation of the scheme. They made clear that it was essential that reforms were adopted throughout the G20 to ensure a “level playing field” internationally.

“In a competitive and international business it is right to make sure that our staff is appropriately and competitively rewarded for sustainable, long-term performance,” they said.

“We therefore welcome the G20 remuneration reforms, and their global nature, as it is essential that banking reward is consistent with effective risk management and that there is parity both nationally and internationally on these issues.

”We will work with the FSA in adopting these remuneration reforms, recognising that all G20 nations have also committed to their implementation to ensure a level playing field.“

Mr Darling said that he expected other financial institutions, both at home and abroad, to follow their lead.

”It is vital that our financial services industry remains at the forefront of the industry globally and takes a responsible and long-term approach to remuneration,“ he said. ”I am therefore pleased that the main banks incorporated in the UK have agreed to lead the way in implementing the agreement reached on bank remuneration at the G20, and expect them to set the standard for all other UK and international financial institutions to follow”.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!