MercoPress. South Atlantic News Agency

UK’s second biggest airport, Gatwick sold to US investment fund

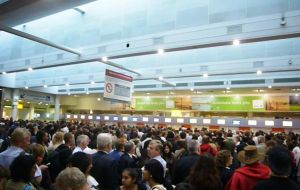

GIP already manages London City Airport handling around 32 million customers a year

GIP already manages London City Airport handling around 32 million customers a year Britain's second-biggest airport will have new owners within weeks following a £1.51 billion deal with a US-based investment fund. Gatwick's current operator BAA, heavily criticised for its stewardship of the West Sussex airport, said it had reached an agreement with Global Infrastructure Partners (GIP).

GIP, which already owns London City Airport handling around 32 million customers a year, immediately promised passengers improved services.

But environmental groups said they feared the sale could become a green light for a “damaging” expansion at Gatwick. Airlines said they hoped the new owners would work closely with them to improve the travelling experience for passengers. The Unite union said GIP had to protect airport workers' pay and pensions, while travelsupermarket.com questioned whether the new owners had the sufficient experience and skills to bring about improved services at Gatwick.

There was immediate speculation that GIP would seek planning permission for a second runway at Gatwick - something that is prohibited before 2019 under a long-standing local agreement. However, a spokesman for GIP said a new runway was an issue for the Government and not for the new owners.

BAA put Gatwick up for sale while the Competition Commission (CC) was inquiring into whether the company's ownership of seven UK airports was anti-competitive. The CC eventually ruled BAA had to sell Gatwick and Stansted and one of either Glasgow or Edinburgh airports - a decision that BAA is currently appealing against at a competition tribunal.

BAA said proceeds from the sale of Gatwick would be used to repay part of its debt which stood at £9.6 billion at the end of June. BAA chief executive Colin Matthews said the company planned to focus on improving Heathrow and its other airports, which include Southampton and Aberdeen.

Michael McGhee, the GIP partner leading the acquisition, said: “We will upgrade and modernise Gatwick Airport to transform the experience for both business and leisure passengers. We plan to work closely with the airlines to improve performance, as we have done successfully at London City Airport.”

Although there can be no second runway before 2019, there are plans to expand Gatwick's North Terminal to allow for an extra five million passengers a year.

The sale of Gatwick is subject to EU merger regulation clearance but this is not expected to be a problem. A GIP spokesman said: “We hope the deal will be completed by early December.”

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!