MercoPress. South Atlantic News Agency

Britain planning windfall tax on bankers’ bonuses

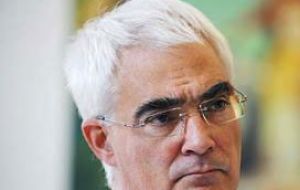

Darling: the better-off have to pay more towards the cost of the economic recovery

Darling: the better-off have to pay more towards the cost of the economic recovery British Chancellor Alistair Darling has left the door open to a windfall tax on bankers' bonuses amid reports that the move could be central to this week's Pre-Budget Report. Darling warned the better-off that they would have to pay more towards the cost of the economic recovery but sidestepped questions about the prospect of a temporary levy targeted at British-based banks.

The BBC has reported that the Treasury was considering a super-tax on bankers who receive bonuses above a certain level.

Other options included increasing national insurance charges for banks that pay big bonuses or taxing investment banks directly.

Mr Darling earlier appeared to play down the prospect of new taxes on the financial sector, but nevertheless stopped well short of ruling them out of this Wednesday's PBR.

Speaking to BBC1's Andrew Marr Show, Mr Darling added: “With all matters of tax - whether it's individuals, whether it's companies - you've got to be fair, you've got to be reasonable. You've also got to have an eye on what the long-term result of all this might be.”

But he also insisted the Government would not accept “wholly unreasonable” bonuses at banks that had been bailed out by the taxpayer.

Amid a row with Royal Bank of Scotland, he added: “We are not going to be held to ransom by people who believe you can pay extraordinarily high bonuses without regard to what's going on.”

He indicated there would be no back-tracking on the new 50p top rate of income tax on earnings of more than £150,000, pencilled in for April.

And, referring to inheritance tax, he went on: “It wouldn't be right to be giving further tax breaks to people at the very top.”

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!