MercoPress. South Atlantic News Agency

Federal Reserve tightens policy raises discount rate to commercial banks

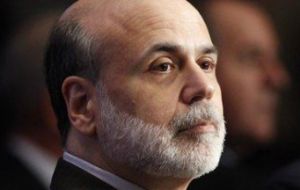

Financial markets conditions improving said Chairman Ben Bernanke

Financial markets conditions improving said Chairman Ben Bernanke The United State Federal Reserve tightened monetary policy Thursday for the first time in more than a year, raising by 0.25 percentage points the discount interest rate at which the US central bank lends directly to commercial banks.

The Fed's discount rate was hiked from 0.5% to 0.75%. The action was unanimously taken “in light of continued improvement in financial market conditions” and becomes effective Friday, a statement said.

The more closely watched federal funds rate remains unchanged at a record low of near 0 percent. Neither the federal funds rate nor the discount rate had been altered since December 2008.

Fed Chairman Ben Bernanke had indicated earlier this month that the central bank was considering a monetary policy move, as Wall Street recovered from a near collapse that began in September 2008.

The Fed said it hoped the new rate hike would encourage banks to seek short-term borrowing from private sources rather than the central bank as the financial sector stabilizes.

In the statement the Fed said that as happened with the closure of a number of extraordinary credit programs earlier this month, “these changes are intended as a further normalization of the Federal Reserve's lending facilities”.

The Fed emphasized that the modifications are not expected to lead to tighter financial conditions for households and businesses and do not signal any change in the outlook for the economy or for monetary policy, which remains about as it was at the January meeting of the Federal Open Market Committee (0 to 0.25%)

In addition, the Board announced that, effective on March 18, the typical maximum maturity for primary credit loans will be shortened to overnight. Primary credit is provided by Reserve Banks on a fully secured basis to depository institutions that are in generally sound condition as a backup source of funds.

Finally, the Board announced that it had raised the minimum bid rate for the Term Auction Facility (TAF) by 1/4 percentage point to 1/2 percent. The final TAF auction will be on March 8, 2010.

Easing the terms of primary credit was one of the Fed's first responses to the financial crisis. On August 17, 2007, it reduced the spread of the primary credit rate over the FOMC's target for the federal funds rate to 1/2 percentage point, from 1 percentage point, and lengthened the typical maximum maturity from overnight to 30 days.

On December 12, 2007, the Federal Reserve created the TAF to further improve the access of depository institutions to term funding.

On March 16, 2008, the Federal Reserve lowered the spread of the primary credit rate over the target federal funds rate to 1/4 percentage point and extended the maximum maturity of primary credit loans to 90 days.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!