MercoPress. South Atlantic News Agency

IMF chief suggests “exploring” possible new international reserve currency

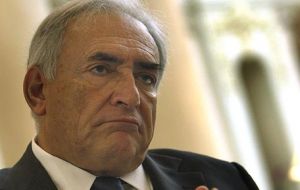

But Dominique Strauss Khan admits “that day has not yet come”

But Dominique Strauss Khan admits “that day has not yet come” The head of the International Monetary Fund said it would be “intellectually healthy to explore” the possible creation of an international reserve currency that would serve as an alternative to the US dollar-.

“That day has not yet come, but I think it is intellectually healthy to explore these kinds of ideas now” said Dominique Strauss-Khan in a speech Friday on the future mandate of the 186-nation Washington-based IMF.

He said that such an asset could be similar to but distinctly different from the IMF special drawing rights, or SDR, the accounting unit that countries use to hold funds within the IMF, based on a basket of major currencies and dating back to 1969.

He said having other alternatives to the dollar “would limit the extent to which the international monetary system as a whole depends on the policies and conditions of a single, albeit dominant, country.”

However Strauss-Kahn admitted that during the recent global financial crisis, the dollar “played its role as a safe haven” asset, and the current international monetary system demonstrated resilience.

“The challenge ahead is to find ways to limit the tension arising from the high demand for precautionary reserves on the one hand and the narrow supply of reserves on the other,” he said.

The suggestion seemed to rekindle the debate since several countries, including China and Russia, have called for an alternative to the US dollar as a reserve currency and have suggested using the IMF internal accounting unit.

The governor of China’s central bank made a similar proposal in March 2009 arguing that the SDR would be more stable and viable than the dollar. The greenback has been the world’s reserve currency since the modern international monetary system, and the IMF were created in Bretton Woods in 1944.

The SDR were created in response to a shortage of two key reserve assets at the time: gold and the dollar. There have only been three general allocations of SDR: in 1970-1972, 1979-1981 and 2009. As of October, there were 324 billion US dollars in SDR.

Strauss-Kahn’s speech also called for improved surveillance of systemic financial risk and expanded tools to respond to economic crises. The IMF which has 186 member nations, saw its resources grow to 850 billion USD in the last year, “which should be sufficient to meet in the coming period,” he said.

In related news on Wednesday Strauss-Khan named Zhu Min, deputy governor of China’s central bank as his special advisor, a move “to strengthen relations between the IMF and emerging economies”.

“As special advisor, he will play an important role in working with me and my management team in meeting the challenges facing our global membership in the period ahead, and in strengthening the Fund's understanding of Asia and emerging markets more generally”, said Strauss-Khan

Zhu became the second Chinese to take a senior management position in a top multilateral organization after Justin Yifu Lin, appointed vice.-president and chief economist of the World Bank in 2008.

“With emerging market and developing countries playing an increasing role in the global economy and financial system, it is a good move for the international financial institutions to include more professionals from those economies in their management to reflect the changes in the world economic landscape and to improve their governance” said the Peoples’ Bank of China in an official release.

The IMF historically led by a European but dominated by the United States, has tried to more engage emerging economies like Brazil, China, India and Russia.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!