MercoPress. South Atlantic News Agency

Crisis lesson: better to rely on international reserves than IMF credit says Brazil

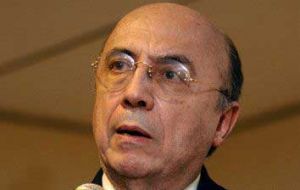

Central Bank president Henrique Meirelles

Central Bank president Henrique Meirelles Brazil’s Central Bank believes it is better for the country to hold its own foreign exchange reserves than to rely on credit lines from international institutions such as the International Monetary Fund.

“It is better to self-insure even if there is a cost associated with that,” Central Bank President Henrique Meirelles said on the sidelines of the annual meeting of the International Development Bank, IDB.

Brazil, with 243 billion US dollars in foreign exchange reserves, proved during the recent global financial crisis that--with certain limits--it can act as a lender of last resort in a foreign currency, namely the US dollar, Meirelles said.

The reserves gave the central bank credibility when it deployed a number of mechanisms to help exporters, the financial system and the foreign exchange markets to deal with the sudden liquidity crisis, he said, adding that some have been removed and others can continue to be withdrawn.

Brazil’s National Development Bank, or BNDES, will end its extraordinary funding to the Brazilian economy in June, but the private sector should be ready to take over, he said. “I think it’s about time to exit all the crisis structures,” Meirelles said.

He added that while multilateral credit lines can be complementary, the crisis showed there are two major problems. First, the IMF would struggle to cope with the sheer volume of demand, and secondly, that the need during the crisis was proven to be higher than had been expected.

And there are still risks swirling around the global economy, the official warned.

“I think that risk aversion increased in international markets as a result of the problems in Europe now is probably the most relevant factor to be watched carefully now by every country,” Meirelles said.

Asked whether he was worried about the strength of the Chinese currency, the official said that Brazil’s diversified economy is driven by domestic demand, and as such, is less affected by the value of the Yuan. “We are watching that closely but this is not necessarily what’s most important for us at this moment,” Meirelles said.

Asked about the impact of US interest rate moves, Meirelles said that although they have some effect “this is not a determinant factor for us.”

Meirelles said popular support for the macroeconomic stability which Brazil currently enjoys means there is “no room” for policymakers to fall into the temptation of attempting changes.

Corporations, a growing middle class, and low income families all back the current economic framework, he said.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentstime is to think innovative and patient again for some problems !

Mar 24th, 2010 - 08:19 am 0.....“Better to rely on international reserves than IMF credit”....

Mar 24th, 2010 - 12:42 pm 0- I couldn't agree more.

.... they envy our international reserves and try to

Mar 24th, 2010 - 02:33 pm 0distract us by the Malvinas problems ..and others .. !!

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!