MercoPress. South Atlantic News Agency

As US economy picks up, revenue increases and budget deficit drops slightly

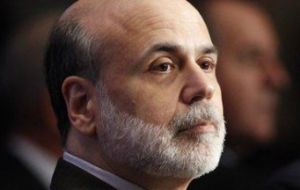

Federal Reserve Chairman Ben S. Bernanke asked Congress for long term plan to reduce deficit

Federal Reserve Chairman Ben S. Bernanke asked Congress for long term plan to reduce deficit The US government posted a smaller budget deficit in May than forecast as a growing economy helped bring in more tax revenue, Treasury Department statistics showed. The excess of spending over revenue fell to 135.9 billion last month from a shortfall of 189.7 billion in May 2009, according to a report issued today in Washington.

For the fiscal year to date, the budget deficit totaled 935.6 billion compared with 992 billion during the prior year to date. The budget deficit is forecast to reach a record 1.6 trillion this fiscal year as the Obama administration boosts spending to revive the economy and lower unemployment following the deepest recession since the 1930s.

Federal Reserve Chairman Ben S. Bernanke has asked lawmakers to come up with a plan to reduce the gap.

The US economy began to recover in the second half of 2009 from the recession that started in December 2007, and growth in GDP allowed the government to cut long-term borrowing for the first time since 2007. GDP expanded at a 3% annual rate in the first quarter, according to statistics from the Commerce Department.

The non-partisan Congressional Budget Office, in a report issued June 7, projected a narrowing of the May deficit to 142 billion. The CBO estimated May receipts were 28 billion more than in the same month last year, with almost half the gain due to lower individual income tax refunds.

Revenue and other income rose 25% to 146.8 billion in May from the same month last year, according to the Treasury. Corporate tax receipts rose 18% for the fiscal year to date to 81.5 billion. Individual income tax collections fell 7.8% to 546.4 billion.

In a report issued May 24, the CBO said the Fed will probably transfer record earnings exceeding 70 billion to the Treasury this year on income from assets including mortgage- backed securities. The Fed returned 47.4 billion last year, primarily from interest earnings on its assets, according to the Fed’s financial statements. The Fed earns income from its Treasury securities, loans to banks and other holdings.

Bernanke this week repeated his call for lawmakers to come up with a long-term plan to reduce the federal budget deficit. “Unless we as a nation make a strong commitment to fiscal responsibility, in the longer run, we will have neither financial stability nor healthy economic growth,” he said.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!