MercoPress. South Atlantic News Agency

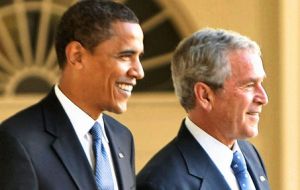

Obama administration wants to end Bush era tax cuts for the rich

The Obama administration and 44% of registered voters concerned with the federal deficit

The Obama administration and 44% of registered voters concerned with the federal deficit The George Bush administration's “misguided” policies are to blame for huge US budget deficits, Treasury Secretary Timothy Geithner charged as he sought to build an election-year case for ending tax cuts for the wealthiest US citizens.

With congressional elections looming in November, Geithner sought to regain the high ground on the issue of who bears responsibility for record budget gaps and to counter Republican labelling of Democrats as tax-and-spend, bailout-happy liberals.

Geithner said extending the Bush-era tax cuts for top income earners, as Republicans want, would force more borrowing to cover lost revenues and crimp more-effective remedies for boosting economic growth and hiring.

“Borrowing to finance tax cuts for the top 2% would be a 700 billion USD fiscal mistake,” Geithner said. “It's not the prescription the economy needs now, and the country can't afford it.”

With the economic recovery showing signs of slowing and unemployment at 9.5%, President Barack Obama's popularity has taken a heavy hit and Democrats on Capitol Hill are at risk of losing their majorities in the Senate and the House of Representatives.

The US budget gap, which hit a record 1.41 trillion USD in fiscal 2009 and is poised to grow wider this year, has unnerved many US citizens. A recent Kaiser Family Foundation poll found that 44% of registered voters rank the deficit as an extremely important issue in deciding how to vote.

The debate over the tax cuts, which are scheduled to expire at the end of this year, has grown hotter in recent weeks.

President Barack Obama and most Democrats want to extend the tax cuts only for individuals making less than 200,000 USD, or families earning less than 250,000 USD, about 97% of all.

Republicans argue the recovery would be jeopardized if all the cuts are not extended, a concern some Democrats share.

Geithner argued that better use could be made of the money that would otherwise flow into the government's coffers. “If people think there's a good case now for more stimuli for the economy, then we should have the debate about what's the best form of stimulus,” he said.

Congress must take action to extend any part of the tax cuts. If the top rates expire, they would revert to 36% and 39.6% from 33% and 35%. Dividend tax rates would also rise from 15% to 40% with no action, a key source of stress among investors.

Another senior Treasury Department official said that the department is assuming Congress will let the tax cuts for the wealthiest Americans expire. The Treasury estimates doing so would reap an extra 37 billion USD a year and it already is setting its borrowing plans on the assumption that will happen

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!