MercoPress. South Atlantic News Agency

FDI in China soars 32.9% in March, totals 30.3 billion USD in first quarter

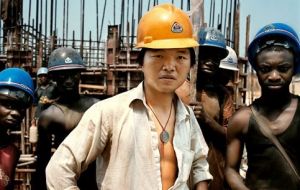

MOC also reported that 769,000 Chinese labourers are working overseas

MOC also reported that 769,000 Chinese labourers are working overseas Foreign direct investment (FDI) in China grew 32.9% year on year in March to 12.52 billion US dollars, the Ministry of Commerce (MOC) reported Tuesday. FDI in China has increased 29.4% in the first quarter to 30.34 billion USD, MOC spokesman Yao Jian said.

FDI inflow in March was significantly higher than February's take of 7.8 billion USD. Compared with 1,156 new foreign-funded enterprises in February, 2,538 new foreign-invested enterprises were approved in March, up 10.5%. In the first quarter the number of foreign-investment companies increased 8.8% over the same period in 2010.

Meanwhile China's outbound DI stood at 8.51 billion USD in the first quarter, up 13.2% percent year on year, bringing China's cumulative outbound non-financial direct investment to 267.3 billion US dollars by the end of March, Yao said

China's outbound direct investment rose 150% both in Australia and the European Union in the first quarter, Yao said.

China also sent about 93,000 labourers overseas in the first quarter, about 10,000 more than the same period last year. About 769,000 Chinese labourers were stationed overseas during the period, nearly 90,000 less than the same period last year, Yao said, adding that the number of Chinese labourers in Africa dropped by about 24,000 year on year to 173,000 at the end of March.

The MOC spokesperson also said that China's exports suffered 66 anti-dumping, anti-subsidy and safeguard measure probes last year, involving 7.14 billion US dollars, according to a ministry report on the trade and investment environment for several of China's major trade partners.

Further on Yao said that China will stick to the policy of boosting imports despite the first quarterly trade deficit in six years.

“Considering China's industrial scale and dependence on raw materials from the outside world, the country would probably keep importing resource products for quite some time,” said Yao.

China experienced a trade deficit of 1.02 billion USD from January to March this year, the first quarterly trade deficit in six years.

Yao attributed the deficit to accelerated imports of resource products in the first three months, saying such imports made Chinese industries vulnerable to global market fluctuations. “We would not like to see a trade deficit caused by price changes and we need to pay attention to that,” he said.

Top Comments

Disclaimer & comment rules-

Read all comments'“Considering China's industrial scale and dependence on raw materials from the outside world, the country would probably keep importing resource products for quite some time,” said Yao.'

Apr 20th, 2011 - 11:55 am 0I would hazard a wild guess that China will keep importing resource products until China decides to de-industrialise (joke). . . . . the large majority of the world's resources . . . . . for as long as these resources last.

After that . . . . we all survive on waste-recycling.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!