MercoPress. South Atlantic News Agency

Brazil slowdown faster than expected: negative growth in the third quarter

Agriculture and exports prevented a greater contraction

Agriculture and exports prevented a greater contraction Brazil’s economy shrank in the third quarter, prompting the government to slash its growth forecast for the year, one week after announcing stimulus measures to contain the spillover from Europe’s debt crisis.

GDP contracted 0.04% from the previous three months, the national statistics agency IBGE said, as credit curbs, higher borrowing costs and budget cuts checked demand. The contraction, the first since the first quarter of 2009, is equivalent to an annualized decline of 0.17%.

As Europe’s crisis deepens, President Dilma Rousseff’s government is trying to reinvigorate the economy with a mix of tax cuts, interest rate reductions and looser bank lending requirements. Finance Minister Guido Mantega cut his growth forecast for this year to 3.2% from 3.8%, while maintaining his target of as much as 5% for 2012.

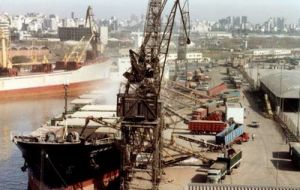

The annualized fall in GDP was led by a 3.4% contraction in industry and a 1.06% decline in services. Agriculture expanded at an annualized pace of 13.56%, while a 7.41% jump in exports prevented a deeper contraction.

The strength of exports is unlikely to be sustained with China’s economy slowing and Europe falling into recession, said Neil Shearing, an emerging markets economist at Capital Economics Ltd. in London.

“Brazil looks like it’s destined to enter a technical recession” Shearing said. “This presents an opportunity to policy makers to get rates into single-digit territory and keep them there”.

The central bank has cut its benchmark interest rate three times since August, pushing it to 11%. The government also stepped in last week to defend growth, slashing 2.8 billion Real (1.6 billion dollars) in taxes, including levies on goods such as flour, wheat, bread and pasta, as well as on foreign purchases of stocks and bonds.

Brazil will under perform its emerging market peers this year, according to International Monetary Fund estimates. GDP will grow 3.8%, while emerging markets and China will expand 6.4% and 9.5% respectively, the IMF said in its September World Economic Outlook. The US will grow 1.6%.

The third-quarter contraction “has little to do with the international crisis and more with the delayed impact of monetary tightening and credit curbs” according to Flavio Serrano, senior economist at Espirito Santo Investment Bank in Sao Paulo.

Brazil’s real has sank 12% against the dollar since June 30, as investors fled higher- yielding emerging-market assets on concern Greece would default on its debt and stall the world economy. The Bovespa stock index dropped 5.6% in the period, extending its decline for the year to 15%.

Brazil is growing at a pace consistent with meeting its 4.5 percent inflation target next year, central bank President Alexandre Tombini said Tuesday in a statement on the bank’s website.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!