MercoPress. South Atlantic News Agency

Kodak given a year to reshape business out of bankruptcy

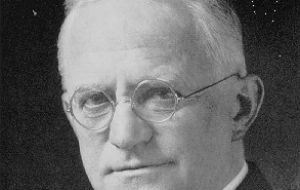

The company founded in 1880 by George Eastman was unable to shift on time from film to digital technology

The company founded in 1880 by George Eastman was unable to shift on time from film to digital technology Eastman Kodak Co. has a little more than a year to reshape its money-losing businesses and deliver a get-out-of-bankruptcy plan. Girded by a 950 million dollar financing deal with Citigroup Inc., the photography pioneer aims to keep operating normally during bankruptcy while it peddles a trove of digital-imaging patents.

After years of mammoth cost-cutting and turnaround efforts, Kodak ran short of cash and sought protection from its creditors Thursday. It is required under its bankruptcy financing terms to produce a reorganization plan by Feb. 15, 2013.

US Bankruptcy Judge Allan Gropper in New York gave Kodak permission to borrow an initial 650 million from Citigroup as it embarks on an effort to focus on printers and copiers.

He also set a June 30 deadline for Kodak to seek his approval of bidding procedures for the sale of 1,100 patents that analysts estimate could fetch at least 2 billion dollars. No buyers have emerged since Kodak started shopping them around in July.

Through negotiations and lawsuits, Kodak has already collected 1.9 billion in patent licensing fees and royalties since 2008. Last week, it intensified efforts to defend its intellectual property by filing patent-infringement lawsuits against Apple Inc., HTC Corp., Samsung Electronics and Fujifilm Corp.

Kodak is also pursuing another high-stakes dispute before the US International Trade Commission in Washington, D.C., against Apple and BlackBerry maker Research in Motion Ltd. over image-preview technology it patented in 2002.

Kodak has said it hopes to generate 1 billion from the two-year-old claim. But the commission, a US arbiter for trade disputes, recently put off its decision until September.

Founded by George Eastman in 1880, Kodak turned photography into a mass commodity at the dawn of the 20th century and was known all over the world for its Brownie and Instamatic cameras and its yellow-and-red film boxes. It was brought down first by Japanese competition and then an inability to keep pace with the shift from film to digital technology.

In its Chapter 11 filing, Kodak said its nearly decade-long overhaul has been undermined since 2008 by a sluggish economy and high restructuring costs. Its payroll has plunged below 19,000 from 70,000 in 2002, and it hasn’t had a profitable year since 2007. The bankruptcy filing prompted the New York Stock Exchange to delist the securities.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsit has had “” cash “” problem which can not finance it's liabilities...!!

Jan 21st, 2012 - 11:35 am 01) As you understand the market, sales and design so much I would apply for the position of CEO - you are bound to get it into the black in a week!

Jan 21st, 2012 - 05:50 pm 0Just like you reckon you can run a car manufacturer! Ha Ha Ha.

Luckily for us his visa was denied...

Jan 23rd, 2012 - 04:58 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!