MercoPress. South Atlantic News Agency

Stiglitz negative about Spanish bail-out, calls it “voodoo economics”

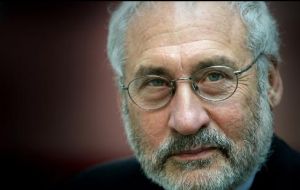

The Nobel-prize winning economist is a long-standing critic of austerity packages

The Nobel-prize winning economist is a long-standing critic of austerity packages The plan to lend money to Spain to heal some of its banks may not work because the government and the country's lenders will in effect be propping each other up, Nobel Prize-winning economist Joseph Stiglitz said.

“The system ... is the Spanish government bails out Spanish banks, and Spanish banks bail out the Spanish government” Stiglitz said in an interview.

The plan to lend Spain up to 100 billion Euros, agreed on Saturday by Euro zone finance ministers, was bigger than most estimates of the needs of Spanish banks that have been hit by the bursting of a real estate bubble, recession and mass unemployment.

If requested in full by Madrid, the bailout would add another 10% to Spain's debt-to-GDP ratio, which was already expected to hit nearly 80% at the end of 2012, up from 68.5% at the end of 2011. That could make it harder and more expensive for the government to sell bonds to international investors.

With Spanish banks, including the Bank of Spain, the main buyers of new Spanish debt in 2011 - according to a report by the Spanish central bank - the risk is that the government may have to ask for help from the same institutions that it is now planning to help.

“It's voodoo economics,” Stiglitz said in an interview on Friday, before the weekend deal to help Spain and its banks was sealed. “It is not going to work and it's not working.”

Instead, Europe should speed up discussion of a common banking system, he said. “There is no way in which when an economy goes into a downturn it will be able to sustain policies that will restore growth without a form of European system.”

Stiglitz, a former economic advisor to US President Bill Clinton, is a long-standing critic of austerity packages. He also wrote book attacking the IMF for policies it has imposed on developing countries as a precondition for emergency loans.

What the European Union has done so far has been minimal and wrong in its policy direction because austerity measures to restore risk have the effect of reducing growth and increasing debt, he said.

“Having firewalls when you're pouring kerosene on the fire is not going to work. You have to actually face the underlying problem, and that is, you're going to have to promote growth,” Stiglitz said.

Instead, sweeping reforms to make Europe more of a fiscal union are needed to solve the debt crisis, reinforce the single currency and ultimately help Germany which, as the richest country in the union, will have to bear the highest cost of guaranteeing any commonly issued debt and providing more resources to boost public spending.

Top Comments

Disclaimer & comment rules-

Read all commentsAccording to the great Spanish,

Jun 11th, 2012 - 09:07 pm 0The euro is her greatest friend since sliced bread,

But these silly Spanish are about to find out, that the butter, is very very expensive.

.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!