MercoPress. South Atlantic News Agency

“The more restrictions on the US dollar, the more people distrust the Argentine peso”

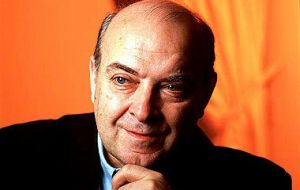

Domingo Cavallo was Economy minister of Carlos Menem and Fernando De la Rúa

Domingo Cavallo was Economy minister of Carlos Menem and Fernando De la Rúa Argentine former economy minister Domingo Cavallo assured that had the restrictions to buy US currency not been applied by the local Government “people would be flocking to buy dollars.”

Cavallo urged the Government House to “immediately come up with a plan that helps curtail the population’s current distrust for the Argentine peso,” and once again defended the convertibility plan, the former minister's brainchild during the 90s that defined the country’s economy for years.

“The more restrictions there are to buy or save in dollars or any other currency, the more people are going to distrust the peso,” said the former cabinet member of the Menem and De la Ruá administrations.

“The logic behind this is that if they will not let me save in any other currency is because they are thinking of making me pay for the inflation tax in pesos,” he stated, highlighting the need to battle the current price hike.

Cavallo slammed Cristina Fernández administration, assuring that “everything they are doing to the economy is counterproductive,” adding that the Government’s currency policy makes it almost impossible for them to reopen the currency market.

There is currently a 30% difference between the official dollar exchange rate and the one used by black market dealers. Officially, one dollar equals 4.50 pesos. The black market is selling them at 5.90 pesos.

“It would be smart for the Government to eliminate all sorts of restrictions so people can choose between the peso and the dollar although, of course, if inflation remains at 25% and interest rates at 10%, no one will want to save in pesos,” he explained.

“When we launched the convertibility plan, countries with a floating currency allowed people to go from a local to a foreign currency without any kind of restrictions,” he stated while referring to his 1990s economic plan.

He assured, nonetheless, that “if the Government chose to lift all restrictions on currency trade, people would flock to buy dollars because there’s an environment of distrust.”

“This has to be done in a context of policies that make people feel that inflation will eventually decrease,” he recommended. “Argentina needs a well implemented, anti-inflationary plan and whoever comes up with it must have a certain level of credibility.”

“In order for the public trust to return, someone needs to completely reassess the way the Argentine economy is being handled,” Cavallo said.

The former minister also criticized Deputy Economy Minister Axel Kicillof, accusing him of “planning for an economy that is completely state-run, just like the Soviet Union’s socialist economies.

In related news the US dollar on Monday at the official marted traded at 4.465/4.505, thus remaining unchanged compared with last Friday's closing price at official exchange agencies.

Meanwhile, the black market's “blue dollar” shows no fixed rate as it trades at the so called “illegal exchange caves” between 5.80 and 5.90 pesos.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsSimple economics that nobody in the CFK government seems to understand.

Jun 12th, 2012 - 08:45 am 0Domingo !........90th years Argentina economy economist ........

Jun 12th, 2012 - 08:59 am 0This guy served in BOTH the Menem and de la Rua governments; kinda says it all, no? Though of different parties they kept him as their economy minister because they had no disagreement about this most important issue. And the result of this guy's incumbency and the consensus he represented? The mother of all economic meltdowns!

Jun 12th, 2012 - 02:08 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!