MercoPress. South Atlantic News Agency

Economic crisis still has six years before returning to decent shape”, says IMF

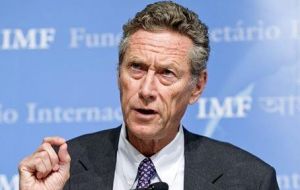

Blanchard said “most emerging markets have to accept an appreciation”

Blanchard said “most emerging markets have to accept an appreciation” It will take at least ten years for the world economy to recover from the economic crisis that started in 2007 and to get back to the normal shape, International Monetary Fund Chief Economist Olivier Blanchard said in an interview published on Wednesday.

“It's not yet a lost decade...But it will surely take at least a decade from the beginning of the crisis for the world economy to get back to decent shape,” Blanchard said in an interview given to the Hungarian website Portfolio.hu.

He pointed out that though the current focus is on Europe's problems as far as economic integration is concerned, the United States with its fiscal problem also faces economic challenges that are yet to be addressed. Japan's problems related to fiscal adjustment are likely to take decades to solve, he added.

On the contrary, China is better positioned to avoid a hard landing, despite slowing growth, as it has probably taken care of its asset boom, Blanchard said.

The economist observed that in a number of advanced countries, notably the US, a return to full health requires replacing some of the domestic demand that fuelled growth before the crisis by external demand.

For some advanced economies to reduce their current account gaps, others must cut their surpluses, the IMF official said. That calls for exchange rate adjustments, he said.

“Most emerging markets have to accept an appreciation,” Blanchard said. “This adjustment is happening, but slowly. It has to happen if the world economy is to go back to health.”

Turning to Europe, Blanchard said adjustment in the Euro area requires a decrease in the relative price of periphery countries and an increase in the relative price of core countries.

“If the ECB wants to maintain 2% inflation for the Euro zone as a whole, this implies, arithmetically, that core countries have to have inflation higher than two percent, periphery countries have to have inflation lower than two percent, until the adjustment has taken place,” he said.

According to Blanchard, a somewhat higher inflation rate for Germany is “necessary and desirable, relative price adjustment”.

Regarding the management of the debt crisis, Blanchard said one has to “walk on the narrow middle path” between more stimulus and reduction in debt stocks. The countries must definitely reduce their high debt levels, but do it without hurting economic growth, he noted.

On inflation targeting, Blanchard said that though it represented progress, it has serious limitations. In situations where countries have stable and low inflation but wrong output just using the policy rate is not enough to solve the problem. “The way to think about monetary policy in the future is that the central bank has in effect two sets of tools,” he said

One is a traditional one, the policy interest rate. The other is the set of macro prudential tools, from loan to value ratios, to cyclical capital ratios.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsWhose fault is it that the world economy is in such a mess, the little man or woman? I am not an economist but common sense will tell a person that far too many countries and people were and still are lving way beyond their means.

Oct 04th, 2012 - 10:40 am 0Regarding the Euro zone I was given this analogy: There are 17 friends continually going out for meals. One person always foots the bill (Dr Angela Merkel) She is becoming tired of this and will eventually refuse to pay the bill. Her family (Germany) is revolting against this extravagance. This is when the Euro zone will break up

The first to leave will be Greece followed by Spain and Italy. I may well be wrong.

The other cause of our woes originated in the derivatives market was the unfettered use of arcane mathematical models to bet on the direction of markets. The notional value of these instruments of mass destruction (as Warren Buffet calls these) must surely run into hundreds of trillions of dollars.

A wise old professor once told me that one should always engage common sense before applying mathematics (blindly).

Of course the yuppy rocket scientists who worked for the banks were instructed by their masters, the banksters, and thought that the good time would never end.

Perhaps they should have realised that there are 7 fat years and 7 lean years or probably 17 lean years now!

So we, the li

Comment removed by the editor.

Oct 04th, 2012 - 10:44 am 01 Ozgood - that's not a very good analogy as part of the problem is that the Germans have refused to pay the bill from the start (which is the only real solution)

Oct 04th, 2012 - 11:23 am 0A better analogy is that Mum (Merkel) has given her children (PIGS) a mobile phone each and they've exceded their fair use contract and all run up bills of thousands of pounds. Currently mum is insisting they settle the bill out of their pocket money for the next 100 years. The mobile company is less keen on this solution.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!