MercoPress. South Atlantic News Agency

Santander keeps growing: absorbs Banesto and Banif and will close 700 branches

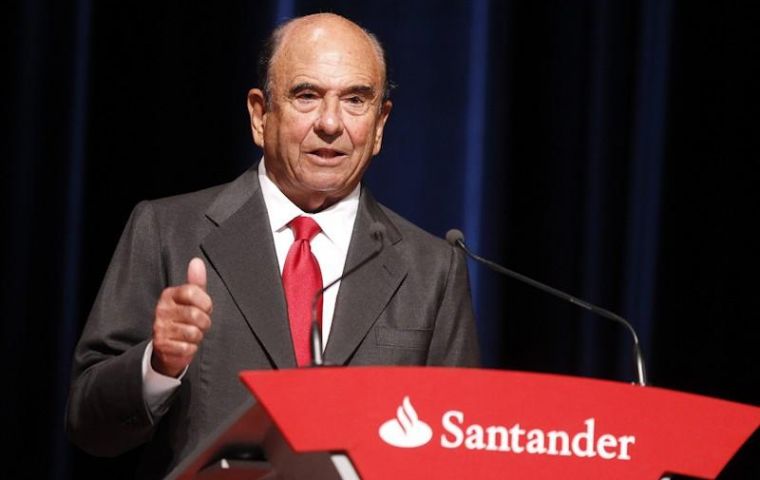

“This is a good transaction for everyone” said Santander chairman Emilio Botin

“This is a good transaction for everyone” said Santander chairman Emilio Botin Banking giant Santander said on Monday that it will absorb two of its Spanish offshoots, closing 700 branches in the latest stage of Spain's great banking shake-up. The biggest bank in the Euro zone by market value, said it could save 520 million Euros a year by absorbing the offshoots, Banesto and Banif.

They will be merged into the Santander brand, which would have 4.000 branches under the same name in Spain.

“This transaction is part of the restructuring of the Spanish financial system, which involves a significant reduction in the number of competitors and the creation of larger financial institutions,” the bank said in a statement.

Santander, which already owns 90% of Banesto, said it would pay the offshoot's minority shareholders with Santander stock, offering a premium of 25%.

“This is a good transaction for everyone,” Santander chairman Emilio Botin said in the statement, saying customers would have access to a global network and staff would have international opportunities.

Spain's Euro zone partners agreed in June to provide up to 100 billion Euros to rescue the crippled banking system, overloaded with bad loans extended during the housing bubble that popped in 2008.

Santander said its merger with Banesto and with its fully owned Banif unit would lead to the closure of about 700 of the three banks' 4.664 branches. But the group said it would lower job numbers gradually through voluntary departures without “abrupt cuts”.

Santander currently employs around 18,000 people in Spain, Banesto 9,000 and Banif 550. The restructuring would save about 10% in costs or 420 million Euros in the third year, it said. Revenues were expected to rise by 100 million Euros in the same timeframe.

The lower costs and higher revenues would mean pre-tax savings of 520 million Euros from the third year, it said. Despite the cuts to the network, Santander said its share of Spain's bank branches would actually rise because of the contraction of the industry overall.

At the end of 2015, Spain would have an estimated 30.000 branches overall, it said, a decline of 35 percent.

Santander, along with BBVA, was one of only two Spanish banks billed strong enough to survive without rescue aid in an audit published in September by US firm Oliver Wyman.

Top Comments

Disclaimer & comment rules-

-

Read all comments'Spanish people' and 'control of money' are two terms that shouldn't appear in the same sentence.

Dec 18th, 2012 - 08:59 am 0Looks like someone in Spain is doing well out of the economic crisis #unsavoury...

Dec 24th, 2012 - 04:38 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!