MercoPress. South Atlantic News Agency

Fed members agree to slow bond purchases but divided over when to start

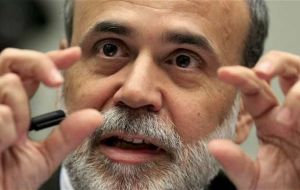

Chairman Bernanke emphasized the importance of being patient

Chairman Bernanke emphasized the importance of being patient The US Federal Reserve members appear to agree on slowing bond purchases by the end of this year if the US economy continues to improve, but remains divided over the exact timing of the move. That's the message from the minutes of the Fed's July 30-31 meeting released Wednesday.

A few policymakers said they wanted to assess more economic data before deciding when to scale back the central bank's 85 billion dollars a month in Treasury and mortgage bond purchases. These policymakers “emphasized the importance of being patient,” the minutes said.

Others said it “might soon be time” to slow the purchases, which have helped keep long-term borrowing rates near record lows.

The minutes give any indication of how fast the Fed would scale back its purchases once it begins -- or whether it would cut back equally on Treasury and mortgage bond buying.

Since the July policy meeting, a few Fed officials have suggested that the central bank could slow the bond buying as soon as September. By then, updated reports on U.S. employment and economic growth will have been issued.

The Fed is considered most likely to slow its bond buying after its September or December policy meeting because after each one, Chairman Ben Bernanke will hold a news conference and could explain such a major step.

The Fed holds eight policy meetings a year; four include news conferences by the chairman. Besides September and December, the Fed will also meet in October before the year ends.

The minutes suggested that future Fed statements may provide no advance warning of any policy shift before it happens. Several members suggested that providing advance notice might confuse stock and bond investors

The minutes released Wednesday show that Fed policymakers agreed that they won't raise the short-term interest rate they control from a record low near zero at least until the unemployment rate fell to 6.5%. Several members even said they were willing to lower that threshold.

The minutes showed that some policymakers were less confident than they were at their June meeting that economic growth will pick up later this year. They cited higher mortgage rates, slower growth overseas and the potential for continuing cuts in government spending as the main reasons.

But several said they thought the housing market would continue to recover despite higher rates. If so, that would provide an important boost to the economy. The Fed officials said banks have become more willing to provide mortgage loans, consumer confidence has increased and mortgage rates are still low by historical standards.

Top Comments

Disclaimer & comment rules-

Read all commentsPhoto caption:

Aug 22nd, 2013 - 11:56 am 0“My balls are this big, but they are not attached to me any longer”.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!