MercoPress. South Atlantic News Agency

Still divided, US Congress lifts government borrowing limit...until 2015

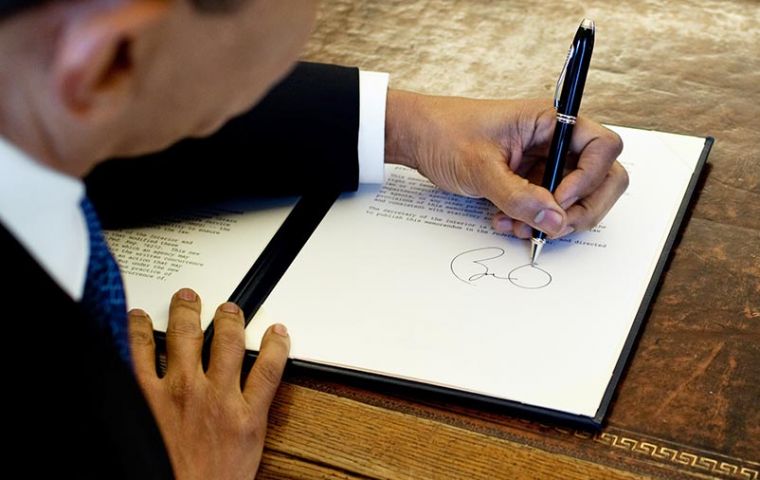

The measure now goes to President Barack Obama to sign into law.

The measure now goes to President Barack Obama to sign into law. The US Senate has sent to the president a bill to raise the country's borrowing limit for another year, ending a series of political standoffs over the issue. The chamber passed the bill on a 55-43 party line vote a day after it narrowly passed the House of Representatives.

US officials had warned of a possible default at the end of the month if Congress did not act. The move came after Republicans gave up on their attempt to win concessions in return for raising the limit.

The measure now goes to President Barack Obama to sign into law.

The bill will waive the 17.2tn debt limit until 15 March 2015, enabling the US government to borrow money to fund its budget obligations and debt service. The White House, the IMF, and most mainstream economists had warned of calamity if the US defaulted on its public debt.

All of the aye votes in the 55-43 Senate count came from Mr Obama's Democrats, who hold the majority in the chamber.

On Tuesday, the Republican-controlled House of Representatives passed the bill 221-201, with only 28 Republicans voting in the affirmative.

Most Republicans in the House and Senate opposed raising the debt limit without concessions from the Democrats, arguing a debt ceiling increase encouraged what they describe as profligate government spending.

In the current and past debt limit fights, the Republican Party's wish-list has included extensive budget cuts, measures that would repeal or undermine Mr Obama's signature healthcare reform, a proposal to force Mr Obama to approve the Keystone XL oil pipeline from Canada, a repeal of recent cuts to pensions for working-age military retirees, and more.

As in the last major Washington DC budget brawl, in September and October, Mr Obama and the Democrats said they would refuse to negotiate over the borrowing limit, arguing raising the limit amounted to the US government making good on spending it had already undertaken.

They demanded a “clean” bill that would raise the debt ceiling without enacting additional policy measures.

“It says something about the expectations that the American people have of Congress that people notice when Congress actually doesn't do direct harm to the economy,” White House spokesman Jay Carney said on Wednesday.

“And by Congress I mean Republicans in Congress. This has been an effect brought about entirely by the ideological passions of House Republicans in particular”.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsChinese inter annual trade surplus increases 14% in January....While in Washington yet another raise to the borrowing limit. Say no more… YB is going to feel real stupid when he swallows this tomorrow...

Feb 13th, 2014 - 02:38 am 0MP gave me a good smile with these two.

Cheers

Now they can “pay” until 2015, at least...

Feb 13th, 2014 - 08:11 am 0Hahahahaha!

@ 2 “Free Energy Stevie”

Feb 13th, 2014 - 11:20 am 0I don’t know why you are laughing.

Did you not understand what I told you months ago about you old commie president Pepe La Puke (and I know it’s the female) who has single handedly committed two generations of actual Uruguayo workers (in the real world, not the fallacy of “government” work) to sovereign debt?

Do you not see the similarities here if Vasquez chooses not to waste money on the stupid hand-outs to the lazy “poor” and frankly looking at the figures and the declining economy I don’t think he can keep on with it? No doubt you will be moaning about Vasquez whatever he does so it won’t really matter what you say will it? As if it does now with you NOT living here!

So the illiterate Tupamaros have nothing to crow about where debt is concerned.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!