MercoPress. South Atlantic News Agency

WHO calls on countries to raise taxes on tobacco to prevent addiction

Every 6 seconds someone dies from tobacco use; tobacco kills up to half of its users.

Every 6 seconds someone dies from tobacco use; tobacco kills up to half of its users.  May 31 has been declared World No Tobacco Day

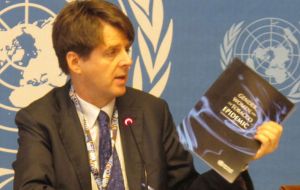

May 31 has been declared World No Tobacco Day  “Price increases are two to three times more effective in reducing tobacco use among young people than among older adults,” says Dr Douglas Bettcher

“Price increases are two to three times more effective in reducing tobacco use among young people than among older adults,” says Dr Douglas Bettcher On World No Tobacco Day (31 May), WHO calls on countries to raise taxes on tobacco to encourage users to stop and prevent other people from becoming addicted to tobacco. Based on 2012 data, WHO estimates that increasing tobacco taxes by 50%, all countries would reduce the number of smokers by 49 million within the next three years and ultimately save 11 million lives.

Today, every 6 seconds someone dies from tobacco use. Tobacco kills up to half of its users. It also incurs considerable costs for families, businesses, and governments. Treating tobacco-related diseases like cancer and heart disease is expensive. And as tobacco-related disease and death often strikes people in the prime of their working lives, productivity and incomes fall.

“Raising taxes on tobacco is the most effective way to reduce use and save lives,” says WHO Director-General Dr Margaret Chan. “Determined action on tobacco tax policy hits the industry where it hurts.”

High prices are particularly effective in discouraging young people (who often have more limited incomes than older adults) from taking up smoking. They also encourage existing young smokers to either reduce their use of tobacco or quit altogether.

“Price increases are two to three times more effective in reducing tobacco use among young people than among older adults,” says Dr Douglas Bettcher, Director of the Department for Prevention of Noncommunicable Diseases at WHO. “Tax policy can be divisive, but this is the tax rise everyone can support. As tobacco taxes go up, death and disease go down.”

WHO calculates that if all countries increased tobacco taxes by 50% per pack, governments would earn an extra 101 billion dollars in global revenue.

“These additional funds could – and should – be used to advance health and other social programs,” adds Bettcher.

Countries such as France and the Philippines have already seen the benefits of imposing high taxes on tobacco. Between the early 1990s and 2005, France tripled its inflation-adjusted cigarette prices. This was followed by sales falling by more than 50%. A few years later the number of young men dying from lung cancer in France started to go down. In the Philippines, one year after increasing taxes, the Government has collected more than the expected revenue and plans to spend 85% of this on health services.

Tobacco use is the world’s leading preventable cause of death. Tobacco kills nearly 6 million people each year, of which more than 600 000 are non-smokers dying from breathing second-hand smoke. If no action is taken, tobacco will kill more than 8 million people every year by 2030 - more than 80% of them among people living in low- and middle-income countries.

Raising taxes on tobacco in support of the reduction of tobacco consumption is a core element of the WHO Framework Convention on Tobacco Control (FCTC), an international treaty that entered into force in 2005 and has been endorsed by 178 Parties. Article 6 of the WHO FCTC, Price and Tax Measures to Reduce the Demand for Tobacco, recognizes that “price and tax measures are an effective and important means of reducing tobacco consumption by various segments of the population in particular young persons”.

In September 2011, world leaders adopted a UN Political Declaration on

noncommunicable diseases (NCDs) at the United Nations General Assembly and committed themselves to accelerate implementation of the WHO FCTC. WHO was requested to complete a number of global assignments that would accelerate national efforts to address NCDs.

Since then a global agenda has been set, based on 9 concrete global NCD targets for 2025 organized around the WHO Global action plan for the prevention and control of NCDs 2013-2020. The plan comprises a set of actions which, when performed collectively by Member States, UN agencies and WHO, will help to achieve a global target of a 25% reduction in premature mortality from NCDs by 2025 and a 30% reduction in the prevalence of tobacco use. The WHO Global action plan indicates that the reduction of affordability of tobacco products by increasing tobacco taxes is a very cost-effective and affordable intervention for all Member States.

The United Nations will hold a comprehensive review on the prevention and control of NCDs 10-11 July 2014 in New York. The review will provide a timely opportunity for rallying political support for the acceleration of actions by governments, international partners and WHO, included in the WHO global action plan – including raising tobacco taxes.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsOh, shut up. More interference with personal freedom.

May 29th, 2014 - 11:31 am 0Nonsense. The only thing that raising taxes on tobacco will do (other than allow governments to steal more from the public), is to encourage smuggling and tax evasion. It will bring the violent, criminal element into the tobacco business, and make it similar to the trade in illegal drugs.

May 29th, 2014 - 05:07 pm 0In the last ten years they have been raised so much here in the UK that is cost more than twice what it cost for a pack of tobacco or pack of cigs. And i'm still smoking! If they keep raising it more and more hardcore smokers will simply turn to the black market, off duty free cigs and baccy, as they cost half the price near enough.

May 30th, 2014 - 02:23 am 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!