MercoPress. South Atlantic News Agency

Holdouts call on Argentina to settle debt payments and recall 30 July deadline

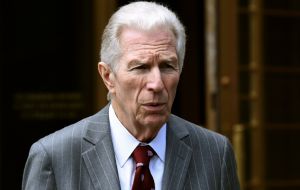

Judge Griesa should be back this week from summer holiday in Montana

Judge Griesa should be back this week from summer holiday in Montana  Special Master Pollack has been holding talks separately with both sides but apparently with no agreement reached

Special Master Pollack has been holding talks separately with both sides but apparently with no agreement reached Aurelius Capital Management, one of the lead holdout creditors seeking to settle with Argentina over sovereign debt payments from its 2002 default, said on Monday the Argentine government faced a new crisis on July 30 unless it engages in real talks.

Argentine officials and the holdout hedge funds met separately with a court-appointed mediator “Special Master” Daniel Pollack on Friday, emerging from his offices after five hours of discussions, with no resolution and no further talks scheduled.

Both sides have ramped up the rhetoric to explain why they are on one level eager to negotiate and on another at pains to show why the other side is not engaging. This is particularly significant since this week New York US District Judge Thomas Griesa returns from summer holidays in Montana.

“Aurelius, together with other pari passu plaintiffs, has done everything it can to negotiate with the government of Argentina, to no avail,” Aurelius said in a statement. “Argentine officials refuse to meet with us or even negotiate with us indirectly. Sadly, this approach gambles with the livelihoods and futures of the Argentine people.”

Friday's meetings were the closest the two sides have come to a face-to-face negotiation, rather than just having their lawyers fight it out before U.S. District Judge Griesa in New York.

Without a deal, the Argentine economy risks tumbling into a new default as it battles a recession, one of the world's highest inflation rates and dwindling foreign reserves.

Argentina continues to request a stay, or suspension, of Griesa's judgments while talks continue. That would give the nation more time beyond a July 30 deadline for a coupon payment to bondholders who agreed to two prior restructurings in 2005 and 2010.

Argentina is also trapped by the RUFO clause (Right under final offer) which in practical terms means that if the holdouts (which it calls vulture funds) receive a better payment deal than that for the 93% swaps, these can demand similar conditions. The RUFO clause stands until January 2015.

“On Friday Argentina’s Ministry of the Economy issued yet another statement calling for the pari passu injunction to be stayed,” Aurelius said. “This is puzzling, because the District Court refused that stay just last month.

”Before that, the injunction had been stayed for nearly 2-1/2 years while Argentina took its appeals. During that period, Argentina rebuffed countless settlement overtures, even by the appellate court. Argentina has demonstrated itself wholly undeserving of another stay now.“

Argentine cabinet chief Jorge Capitanich made no mention of the debt talks in his regular briefing on Monday morning.

Buenos Aires said in a statement on Friday that it was willing to continue talks but did not specify if it would or when. It has also argued it is being pushed into default by the holdouts.

During the World Cup final on Sunday, state-run Argentine television once again screened a fiery, nationalistic advertisement, playing sound bites of Latin American leaders rallying behind Argentina in its battle against the holdouts.

Aurelius said: ”Absent a deal, Argentina’s next sovereign debt crisis will start on July 30. There is still time to avoid that outcome, but only if the Argentine government commences serious discussions with us immediately.”

Holdout creditors, led by Aurelius and Elliott Management Corp, won a judgment of 1.33 billion dollars plus accrued interest in 2012.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsWow 2 weeks to go!

Jul 15th, 2014 - 07:42 am 0Why dont you ask the Falklands for help...........

Jul 15th, 2014 - 10:05 am 0The football's over- time to face reality.

Jul 15th, 2014 - 10:48 am 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!