MercoPress. South Atlantic News Agency

Argentine private banks prepared to buy holdouts' credit; Kicillof/Pollack talks to continue today

“These were the first face-to-face talks between the parties. There was a frank exchange of views and concerns; issues remain unresolved”, said Pollack

“These were the first face-to-face talks between the parties. There was a frank exchange of views and concerns; issues remain unresolved”, said Pollack  “We are in a recess and we will keep on working,” assured Kicillof who flew to New York from Caracas for the final negotiations.

“We are in a recess and we will keep on working,” assured Kicillof who flew to New York from Caracas for the final negotiations.  ADEBA is offering 250 million dollars as guarantee, hoping to avoid the 30 July default

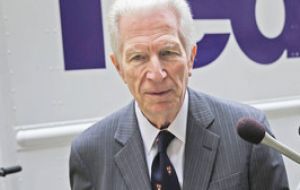

ADEBA is offering 250 million dollars as guarantee, hoping to avoid the 30 July default “Special Master” Daniel Pollack, the mediator appointed by US judge Griesa to resolve the dispute between Argentina and the speculative funds' holdouts said the parts talked “face to face” for the first time and assured a new meeting will be confirmed during the day. If a deal is not reached Wednesday sunset Argentina could again fall into default.

Pollack published a statement minutes after Economy Minister Axel Kicillof and holdouts representatives left his office following 11 hours of negotiations, early Wednesday.

”A delegation from the Republic of Argentina, led by the Minister of the Economy, Axel Kicillof, and the principals of the large Bondholders met tonight for several hours in my office and in my presence.

“These were the first face-to-face talks between the parties. There was a frank exchange of views and concerns. The issues that divide the parties remain unresolved,” Pollack said, while adding “Whether and when the parties will meet tomorrow (July 30) remains to be determined overnight.“

Kicillof arrived to New York after joining President Cristina Fernández at the Mercosur summit in Venezuela.

“We are in a recess and we will keep on working,” assured Kicillof.

Delegates of the Economy Ministry - Attorney at law Angelina Abbona, Finance Secretary Pablo López and Legal and Administrative Secretary Fedrico Thea had met with Pollack earlier on Tuesday until they were joined by Kicillof, following news that Argentine private banks are prepared to reach an agreement with the holdouts, thus avoiding default at the sunset of Wednesday.

Kicillof following the meeting said he was not going to make any statements since the meeting 'is ongoing there's nothing I can say about the results'. He added “we are working hard”.

From Buenos Aires it was announced that summoned through an emergency meeting, the Argentine private banks association (Adeba) agreed to offer the litigation a 250 million dollar guarantee as a preventive measure to avoid a default.

ADEBA’s 250 million dollars could stimulate NML Elliot hedge fund to request Judge Griesa the reapplication of the ‘stay measure’ in order to prevent future embargos on Argentine assets, and by doing so extend negotiations until January 2015.

Accordingly a meeting of Argentine private banks representatives with holdouts is expected sometime on Wednesday when the two sides would agree on the sale of the defaulted bonds, thus freeing Argentina of any commitment with holdouts and exposure to the RUFO clause Right Upon Final Offer. In other words the 2005 and 2010 restructured bonds are entitled to the same improved (and immediate) conditions of similar bonds.

Since it would be a private to private transaction, if the holdouts approve, Judge Griesa could then re-impose the stay action which means Argentina could then pay the restructured bonds with the blocked funds in New York banks and with no fear of breach of US law or the RUFO clause or the pari-passu ruling.

The 250 million dollar deposit from the Argentine private banks would act as a guarantee for holdouts to engage in negotiations referred to the non re-structured bonds deal with an agreed time limit of 90 days, which would be blessed by Judge Griesa if all sides agree.

If all hopefully works as planned at the most Argentina could be exposed to a one/two day default while negotiations are wrapped up.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsFinally some movement. Well done ADEBA for having the balls the push the government into action. Whether this actually gets done, we'll have to see but it is a move in the right direction.

Jul 30th, 2014 - 08:29 am 0The only note of caution being the following phrase:

“These were the first face-to-face talks between the parties. There was a frank exchange of views and concerns. The issues that divide the parties remain unresolved,”

And also the fact the CFK spent most of her speach yesterday attacking the Judge and saying the the default won't be a default becuase they aren't clever enough to understand simple concepts...

From bubblear,com

Jul 30th, 2014 - 08:41 am 0“In the irony of the century, what could end up saving Argentina from default and a deepening of the current recession is a consortium of banks. These ultra-capitalist, usurers, who apparently symbolize all that is wrong with the neoliberal, capitalist, western-world order that has been exploiting Argentina of its public finances but could end up being its savior. I guess logic and incentives beat populism in the end?”

Full round-up at the website.

This is worth a read:

Jul 30th, 2014 - 08:54 am 0http://bubblear.com/argentina-default-is-paul-singer-playing-both-sides/

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!