MercoPress. South Atlantic News Agency

UK government begins sale of rescued RBS, but a third below the price it paid

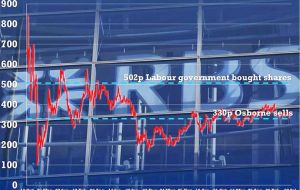

Chancellor George Osborne is facing criticism for selling the shares at well below the price of about 500p the then Labour government paid for them.

Chancellor George Osborne is facing criticism for selling the shares at well below the price of about 500p the then Labour government paid for them.  Ms Baldwin, Economic Secretary to the Treasury, said Osborne was following Bank of England Governor Carney's advice that a sale should now commence.

Ms Baldwin, Economic Secretary to the Treasury, said Osborne was following Bank of England Governor Carney's advice that a sale should now commence.  But Barbara Keeley, the Labour shadow treasury minister, accused the Cameron government of “casually” losing £1bn.

But Barbara Keeley, the Labour shadow treasury minister, accused the Cameron government of “casually” losing £1bn.  UK bailed out RBS in 2008 and 2009 by buying shares for £45bn and supplying it with cheap funds. The sale cuts the government's stake in RBS to 73%.

UK bailed out RBS in 2008 and 2009 by buying shares for £45bn and supplying it with cheap funds. The sale cuts the government's stake in RBS to 73%. The British government has begun its sell-off of shares in part-nationalized lender Royal Bank of Scotland, raising £2.1bn, a third below the price it paid. It sold a 5.4% stake at 330p a share, a 7.6p discount on Monday's closing price.

Chancellor George Osborne is facing criticism for selling the shares at well below the price of about 500p the then Labor government paid for them. The 170p difference represents a loss of about £1.07bn on the shares sold. The government's sale cuts the government's stake in RBS to 73%.

RBS shares closed on Tuesday at 339p, up 1.4p, or 0.4%, valuing the bank at £39.2bn. The UK bailed out RBS in 2008 and 2009 by buying shares for £45bn and supplying it with cheap funds.

Ian Gordon, a banking analyst at Investec, told the BBC's Today program: “The taxpayer is being short-changed”. He added that shares could have been sold for a higher price in February, when they were changing hands for more than 400p.

However, James Bevan, chief investment officer at money manager CCLA Investment Management, said the loss was “relatively small”.

The point of the UK's rescue of the bank was to prevent further damage to the economy, rather than to turn a profit on the shares, he told BBC Radio 5 live.

RBS chief executive Ross McEwan said: “I'm pleased the government has started to sell down its stake.

”It's an important moment and reflects the progress we are making to become a stronger, simpler and fairer bank. There is more work to be done but we're determined to build a bank the country can be proud of.“

RBS reported a half-year loss of £153m last week after setting aside more money for repaying customers and potential legal settlements. However, for the three months to the end of June, the bank posted a profit of £293m.

Harriett Baldwin, Economic Secretary to the Treasury, said Mr Osborne was following Bank of England Governor Mark Carney's advice that a sale should now commence.

Mr Carney said in June the phased sell-off ”would promote financial stability” and benefit the wider economy. As governor, Mr Carney is also chairman of the board of the Financial Policy Committee, which is tasked with protecting the stability of the financial system.

UK Financial Investments (UKFI), the company through which the Treasury owns shares in banks like RBS, “has taken the view that there is a window of opportunity to start this process,” she told the Today program.

UKFI owns the UK's stakes in Lloyds Banking Group, RBS, and the remains of the fully-nationalized lenders; Bradford & Bingley and the more-toxic parts of Northern Rock. It is run by a board who manage the investments “commercially” and report to Mr Osborne as chancellor.

But Barbara Keeley, the shadow treasury minister, accused the government of “casually” losing £1bn.

“The most important question for the tax-payer - are we getting good value for our money? This used to be something the chancellor used to care about, he said he would only sell these RBS shares when we get good value - clearly that's not now,” she told Today.

Top Comments

Disclaimer & comment rules-

Read all comments“The Cunt Brown” © Jeremy Clarkson 2010 lost far more than what this cunt is claiming, especially in the famous incompetent handling of selling the country's gold.

Aug 05th, 2015 - 12:45 pm 0I bet she has ignored all the fees that RBS have paid to the government over the years and even the City reckon it will be a break-even deal.

Wait until Cunt MkII, Corbyn, gets into the Labour “Leaders” position: then she will be out on her arse and good riddance.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!