MercoPress. South Atlantic News Agency

Economists' open letter to UN: political power must be preeminent in handling economic policy

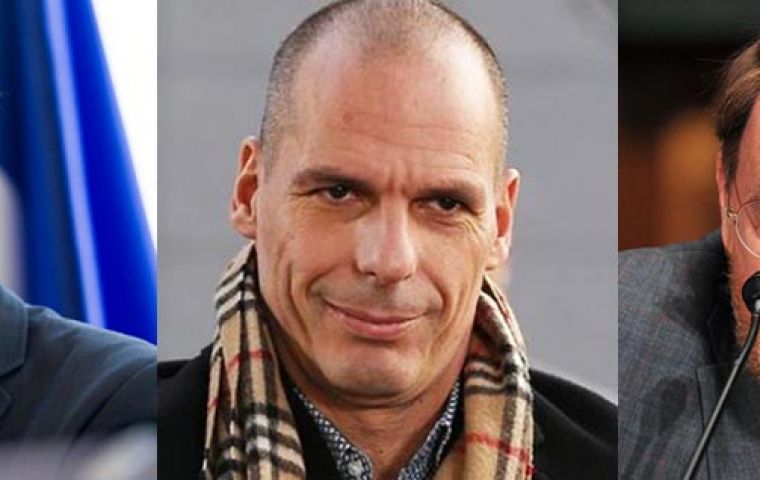

Thomas Piketty, (Paris School of Economics), Yanos Varoufakis, former Greek minister of Finance, James Galbraith (University of Texas, Austin)

Thomas Piketty, (Paris School of Economics), Yanos Varoufakis, former Greek minister of Finance, James Galbraith (University of Texas, Austin)  The UN vote today provides a stark choice between the democratic handling of sovereign debt matters and the continuing rule by debt markets.

The UN vote today provides a stark choice between the democratic handling of sovereign debt matters and the continuing rule by debt markets.  A similar initiative failed in 2003 at the IMF. Today, while the position of European countries remains unclear, their support is fundamental

A similar initiative failed in 2003 at the IMF. Today, while the position of European countries remains unclear, their support is fundamental European countries must support the United Nations’ proposals for sovereign debt restructuring! – Open letter to the UN by 19 economists.On Thursday September 10, the United Nations General Assembly will vote on nine principles concerning the restructuring of sovereign debts.

Abiding by such principles would have avoided the pitfalls of the Greek crisis, in which political representatives gave in to creditor demands despite their lack of economic sense and their disastrous social impact. This public interest resolution must be supported by all European states and brought into the public debate.

The Greek crisis has made clear that individual states acting alone cannot negotiate reasonable conditions for the restructuring of their debt within the current political framework, even though these debts are often unsustainable over the long term. Throughout its negotiations with creditor institutions, Greece faced a stubborn refusal to consider any debt restructuring, even though this refusal stood in contradiction to the IMF’s own recommendations.

At the UN in New York exactly one year ago, Argentina, with the support of the 134 countries of the G77, proposed creating a committee aimed at establishing an international legal framework for the restructuring of sovereign debts. This committee, backed up by experts of the UNCTAD, today submits to vote nine principles that should be respected when restructuring sovereign debt: sovereignty, good faith, transparency, impartiality, equitable treatment, sovereign immunity, legitimacy, sustainability and majority restructuring.

In recent decades, a debt market has emerged that states are constrained to submit to.

Argentina, standing at the forefront of these efforts, has been fending off “vulture funds” ever since it restructured its debt. These funds recently succeeded in freezing Argentina’s assets in the United States through the intervention of the American courts.

Yesterday Argentina, today Greece, and tomorrow perhaps France as well: any indebted country can be blocked from restructuring its debt in spite of all common sense. Establishing a legal framework for debt restructuring, allowing each state to solve its debt problems without risking financial collapse or the loss of its sovereignty, is a matter of great urgency in promoting financial stability.

These nine principles reaffirm the preeminence of political power in handling economic policy.

They limit the depoliticisation of the financial system, which until now has not left any alternative to austerity and instead has held states hostages to creditor demands. The UN vote today provides a stark choice between the democratic handling of sovereign debt matters and the continuing rule by debt markets.

A similar initiative failed in 2003 at the IMF. Today, while the position of European countries remains unclear, their support is fundamental for this resolution to be put into practice. Thus far they have kept away from the process, and did not express support for the creation of the committee. The Greek drama that unfolded over the summer makes clear that there is no time left to dither.

This summer’s sham negotiations have caused many Europeans to retreat into nationalism and express defiance towards international institutions. However, Europeans must reaffirm that democratic rights, rather than the dictates of the market, are at the heart of international governance. We therefore call all European states to vote in favour of this resolution.

Signatories: Thomas Piketty, (Paris School of Economics); Yanos Varoufakis, former Greek minister of Finannce; James Galbraith (University of Texas, Austin); Heiner Flassbeck (UNCTAD former chief economist); Martín Guzmán (Columbia University); Jacques Généreux (Institut d'études politiques de Paris); Steve Keen (Universidad de Kingston); Gabriel Colletis (Universidad Toulouse 1); Michel Husson (Institute de Recherches Economiques et Sociales); Benjamin Lemoine (Universidad París-Dauphine); Mariana Mazzucato (Universidad de Sussex); Robert Salais (IDHES, Francia); Marc Bloch; Bruno Théret (Universidad Paris-Dauphine); Xavier Timbeau (Sciences Po) Gennaro Zezza (Levy Economics Institute); Giovanni Dosi (Scuola Superiore Sant'Anna); y Engelbert Stockhammer (Universidad de Kingston).

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsI wonder how many of this group of “economists” have received goodies from argieland. I can see this resolution getting a lot of support. After all, it will be voted on by politicians. I do trust that some honest “representative” will stand up and remind the GA that the majority of legal systems don't permit legislation to have retrospective effect.

Sep 10th, 2015 - 09:18 am 0I also hope that people who consider buying bonds will avoid those of countries, like argieland, that have a history of corruption, scams and most other forms of illegality.

Europe is still paying and will pay an extremely high price for servitude to the United States. Most likely it would never recover.

Sep 10th, 2015 - 11:20 am 0And the United States will only maintain power while the dollar dominate world trade. If the dollar lose control in a short the US space of time will become the greatest catastrophe that humanity has ever seen, and when I speak of the United States I refer to everything that is connected with it (people, companies, debt , economic partners).

What you see happening in Syria, Iraq or Libya is a small drop of water compared to what will happen with the West.

I am amazed that when people borrow large sums of money and can't repay them in the agreed timescale, then bankruptcy ensues.

Sep 10th, 2015 - 02:42 pm 0Why is this same rule not acceptable to countries who mismanage their finances, borrow huge sums of money and then expect creditors to accept that they have lost their money. Utter nonsense.

Only in the situation where a country is unable to pay back in the agreed timescales because the country's systems would collapse. As no further payments would be possible, repayment might then be renegotiated, but it should never be overlooked

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!