MercoPress. South Atlantic News Agency

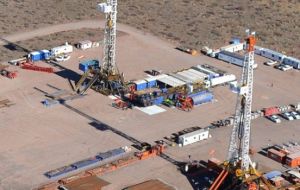

YPF focusing on boosting natural gas production; investors waiting for “post-election clarity”

“We have been shifting and we will continue to shift as much as we can from oil to natural gas production,” Chief Financial Officer Daniel Gonzalez said

“We have been shifting and we will continue to shift as much as we can from oil to natural gas production,” Chief Financial Officer Daniel Gonzalez said  Argentina relies on gas to meet 53% of its energy demand, and is running a 30% deficit that it is filling with imports from Bolivia and the global market

Argentina relies on gas to meet 53% of its energy demand, and is running a 30% deficit that it is filling with imports from Bolivia and the global market  YPF is working with Chevron, Dow Chemical and Petronas on shale projects, and has held talks with other companies like Gazprom on future ventures.

YPF is working with Chevron, Dow Chemical and Petronas on shale projects, and has held talks with other companies like Gazprom on future ventures.  Investors are waiting for post-election clarity on economic and energy policies before “making any decisions,” Gonzalez said.

Investors are waiting for post-election clarity on economic and energy policies before “making any decisions,” Gonzalez said. Argentina's state-run energy company YPF said on Friday it plans to focus on boosting natural gas production in 2016, while also pursuing a gradual reduction in drilling and completion costs and looking for more partnerships for shale and tight play projects. It also admitted that potential investors are waiting for post-election clarity on economic and energy policies before “making any decisions”.

“We have been shifting and we will continue to shift as much as we can from oil to natural gas production,” Chief Financial Officer Daniel Gonzalez said during a conference call. “The fundamentals for natural gas are very strong in Argentina. There will be more gas production in 2016.”

Argentina relies on gas to meet 53% of its energy demand, and it is running a 30% deficit in gas demand that it is filling with imports by pipeline from Bolivia and the global market in the form of LNG.

A 20% drop in production to 117 million cu m/day over the past decade has left pipelines with slack capacity that can be filled with increased output, in particular from the southwest of the country, a region that holds most of Argentina's substantial shale and tight resources.

Gonzalez, however, warned it would take YPF time to become more aggressive in gas drilling. “You need to have the projects in place in order to not take any unnecessary risks,” he said.

One shale gas project in place is El Orejano in Vaca Muerta, a southwestern play with about 300 Tcf of gas resources. Gonzalez said production from that project -- a partnership with Dow Chemical -- should reach 1 million cu m/d by the end of the year.

YPF also is exploring for shale gas in other fields targeting the Vaca Muerta formation, with two wells drilled on La Ribera in the third quarter of this year.

“We might start doing drilling on other areas next year,” Gonzalez said.

YPF's gas production fell to 44.4 million cu m/d in the third quarter, compared with 45 million cu m/d in the year-ago period, in part because of the delayed startup of projects in hopes will offset declines in maturing conventional reserves and because of an asset swap of conventional fields for unconventional ones.

Over the same period, its oil production rose 1.3% to 249,300 b/d from 246,000 b/d.

The company's combined Q3 production included 46,200 barrels of oil equivalent/day of output from unconventional resources, compared with 43,300 boe/d in the second quarter, YPF said. Of the third-quarter production, 21,300 b/d was crude, 11,500 b/d was NGLs and 2.1 million cu m/d was gas.

YPF expects capital expenditures of between $5 billion and $6 billion in 2016, in line with 2015, Gonzalez said. The brunt of the financing will continue to come from cash flow from sales and bond issues, he said. At the same time, YPF will continue to look for partners to develop new projects in 50/50 ventures.

“We have different people looking at different projects, both in shale as well as in tight” formations, he said.

However, he said there is no hurry because “we already have a lot of food on our plate with the JVs we have in place.”

YPF is working with Chevron, Dow Chemical and Petronas on shale projects, and has held talks with other companies like Gazprom on future ventures.

“The strategy will continue to be to develop the shale with partners,” Gonzalez said. There are two reasons for this. The first is that low global oil prices have led to a cutback in investment in the industry. The second is the economic and political uncertainty in Argentina, which will get a new government December 10.

The next president will be decided at a November 22 runoff election, pitting Daniel Scioli, a moderate candidate of the populist-left ruling party, against conservative businessman Mauricio Macri.

Investors are waiting for post-election clarity on economic and energy policies before “making any decisions,” Gonzalez said.

The next president will have to address an overvalued exchange rate, price controls, debt defaults, dwindling dollar reserves, nearly 30% inflation and a lack of access to global financial markets. Another deterrent to investment is a restraint on companies sending profits out of the country.

YPF produces 43% of Argentina's 536,000 b/d of crude and 30% of its 118.4 million cu m/d of gas, according to the Argentine Oil and Gas Institute, an industry group. It also has a 55% share of diesel and gasoline sales, according to company estimates.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsInvesting in “ PUTA MUERTE ” is a no no, do they know how much it costs to drill and make shale gas commercial? They need to invest U$S 200 BILLION to make it possible. Never trust an Argie, if you shake hands with one make sure you have all your fingers afterwards.

Nov 07th, 2015 - 12:03 pm 0“We have been shifting“

Nov 08th, 2015 - 05:22 pm 0Well, you argies of YPF are a shifty bunch of characters!

”It also admitted that potential investors are waiting for post-election clarity on economic and energy policies before “making any decisions”.

I can tell 'investors' about the post election clarity now!

DON'T DO IT, YOU WILL NEVER GET YOUR MONEY BACK.

There, that wasn't difficult, was it?

The story shows the challenges of a reorganized energy corporation in today's context of depressed prices.

Nov 08th, 2015 - 05:36 pm 0In spite of the usual free-market arguments, it's vital for a country to be in control of its energy needs instead of being at the mercy of private interests who care about their own bottom line (as it should be).

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!