MercoPress. South Atlantic News Agency

Argentina close to a full agreement with holdouts: US$ 6.5bn offer to end the litigation

“The agreement was awesome,” Caputo said in New York. “We have had a good reception of the proposals and I feel optimistic.”

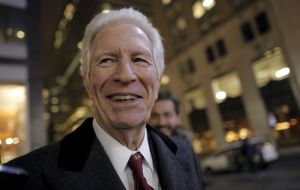

“The agreement was awesome,” Caputo said in New York. “We have had a good reception of the proposals and I feel optimistic.”  “A happy day for everyone” said a grinning Pollack, as he stopped to speak with reporters before resuming his walk north on Park Ave.

“A happy day for everyone” said a grinning Pollack, as he stopped to speak with reporters before resuming his walk north on Park Ave.  If a settlement is reached, Macri's next challenge will be to push it through Argentina's Congress, where no party holds a lower house majority.

If a settlement is reached, Macri's next challenge will be to push it through Argentina's Congress, where no party holds a lower house majority.  The Argentine finance ministry said the offer entailed “a payment of approximately $6.5 billion if all the bondholders accept it”.

The Argentine finance ministry said the offer entailed “a payment of approximately $6.5 billion if all the bondholders accept it”.  Mediator Daniel Pollack praised Macri's “courage and flexibility”. Macri's focus on reaching a deal contrasts starkly with the hostile stance of Cristina Fernandez

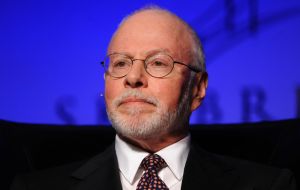

Mediator Daniel Pollack praised Macri's “courage and flexibility”. Macri's focus on reaching a deal contrasts starkly with the hostile stance of Cristina Fernandez  Montreux Equity Partners and Dart Management were the two funds that accepted the proposal, but not Elliott Management and Aurelius Capital

Montreux Equity Partners and Dart Management were the two funds that accepted the proposal, but not Elliott Management and Aurelius Capital Argentina offered a $6.5 billion cash payment to creditors suing the country over defaulted bonds on Friday, seeking to end an exhausting 14-year legal battle, “the sovereign debt trial of the century”, that transformed the country into a financial markets pariah. Two out of six leading bondholders have already accepted the offer, the U.S. court-appointed mediator said, hailing the proposal by Argentina's new, business-friendly government as an “historic breakthrough”.

The offer, if accepted by all litigating bondholders, would represent a roughly 25% discount or so-called haircut for creditors who filed claims of about $9 billion.

The turning point in the legal fight stemming from Argentina's record default on around $100 billion in 2002 comes less than two months after President Mauricio Macri took office and expressed his commitment to a deal.

If Macri manages to clinch an agreement, cash-strapped Argentina will be able to emerge from default and return to global capital markets to finance badly-needed infrastructure such as new roads and railways. Lower borrowing costs would also be a boon for corporate and regional finances in Latin America's third largest economy.

The Argentine finance ministry said the offer entailed “a payment of approximately $6.5 billion if all the bondholders accept it”. It followed five days of intense talks in New York led by Finance Secretary Luis Caputo. The former Deutsche Bank bond trader brought a market mindset to discussions after Argentina's previous negotiator, former Economy Minister Axel Kicillof, an academic, frequently clashed with bondholders.

“The agreement was awesome,” Caputo told reporters after emerging from the mediator’s office in New York. “We have had a good reception of the proposals and I feel optimistic.”

Montreux Equity Partners and Dart Management were the two funds that accepted the proposal, according to the ministry. But the two lead creditors Elliott Management and Aurelius Capital Management, both declined to comment on the offer.

The payment will be financed through new sovereign debt issuances. Alejo Costa at the Buenos Aires-based investment bank Puente said a cash payment placed the financing risk in Argentina's hands and offered the investors a premium.

Mediator Daniel Pollack praised Macri's “courage and flexibility”. Macri's focus on reaching a deal with holdouts contrasts starkly with the hostile stance of his predecessor Cristina Fernandez, who refused to settle with the creditors she referred to as “vultures”.

Pollack said negotiations would continue with the four leading holdout investors that had not accepted the deal. Apparently Judge Thomas Griesa is also enthusiastic about a quick outcome to the litigation and has put a deadline, 29 February.

“A happy day for everyone” said a grinning Pollack, as he stopped to speak with reporters before resuming his walk north on Park Ave.

If a settlement is reached, Macri's next challenge will be to push it through Argentina's Congress, where no party holds a lower house majority. A deal would likely further bolster investor confidence in Macri's government, which has already won market approval for ending capital controls, unifying Argentina's multiple exchange rates and cutting export taxes in a bid to provide a more business-friendly framework.

The offer contained two separate proposals. The first offers holders of defaulted debt who never joined the U.S. lawsuit full payment on the principle value of their bonds plus 50%, mirroring a deal reached with 50,000 Italian creditors earlier this week.

The second proposal applies to all creditors who have sued Argentina through the U.S. law courts. It offers a 30% reduction on a creditor's total claim. If the investor agrees within two weeks, the haircut will be trimmed to 27.5%.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsWhat a difference a sensible, mature leader makes. Argentina is finally facing up to its responsibilities and will benefit in the long term. Unless you agree with Toby that foreign Western money is the source of all evil. Which is basically another way of saying Argentina isn't mature enough to manage its loans so it's safer to cut up its credit cards.

Feb 06th, 2016 - 08:22 am 0Anyway, I am very happy that Argentina is going to pay most of its debt back.

We should wait to see what Singer has to say. He is the prime mover in finally bringing argieland to its knees.

Feb 06th, 2016 - 11:10 am 0Dart Management is broadly the equivalent of Singer and Aurelius and they will need to decide if holding out further is going to confirm what a lot of people have said about them 'being sharks'.

Feb 06th, 2016 - 11:17 am 0Now is the time to prove that to be incorrect. In reality I suspect they are not that far from what they really want as a settlement.

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!