MercoPress. South Atlantic News Agency

Griesa prepared to drop injunction if Argentine congress repeals 'lock law'

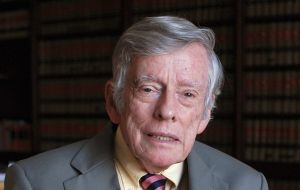

Judge Griesa said he would drop the injunctions after Argentina repeals domestic laws ('lock laws') that prevent the country from making payments to holdouts

Judge Griesa said he would drop the injunctions after Argentina repeals domestic laws ('lock laws') that prevent the country from making payments to holdouts  Macri’s administration has moved to settle with several holdouts, striking a $1.35 billion settlement with a group of Italian investors, among several other deals.

Macri’s administration has moved to settle with several holdouts, striking a $1.35 billion settlement with a group of Italian investors, among several other deals.  Ex president Cristina Fernandez and her administration called the hedge funds “vultures” and “financial terrorists,” and went as far as denigrating Judge Griesa.

Ex president Cristina Fernandez and her administration called the hedge funds “vultures” and “financial terrorists,” and went as far as denigrating Judge Griesa.  The holdout investors include a group of hedge funds led by NML Capital, a unit of the billionaire Paul E. Singer’s Elliott Management.

The holdout investors include a group of hedge funds led by NML Capital, a unit of the billionaire Paul E. Singer’s Elliott Management. The judge presiding over a long-running battle between Argentina and a group of New York hedge funds said on Friday that he would lift an injunction that had locked Argentina out of international markets, if certain conditions are met.

The ruling represents a sharp turnaround by Judge Thomas Griesa of the United States District Court in Manhattan, who had previously prevented Argentina from raising new money or paying its creditors before paying investors holding its defaulted debt.

The holdout investors include a group of hedge funds led by NML Capital, a unit of the billionaire Paul E. Singer’s Elliott Management. They have battled with Argentina for more than a decade in a fight that stems from 2001, when the country defaulted on nearly $100 billion of debt.

Argentina later offered twice to restructure the bonds for new and cheaper ones, but the holdouts refused and won a series of victories in the United States courts in recent years. Friday’s ruling now weakens the hand of the holdouts in negotiating with Argentina.

In his ruling on Friday, Judge Griesa said he would drop the injunctions after Argentina repeals domestic laws ('lock laws') that prevent the country from making payments to the holdouts and makes full payments to bondholders who settle with Argentina by Feb. 29.

The creditors and Argentina’s previous president, Cristina Fernández reached an impasse after years of mudslinging and rulings that led the country to default on its debt again in 2014. The ex president and her administration called the hedge funds “vultures” and “financial terrorists,” and went as far as denigrating Judge Griesa.

All those years, Argentina “never seriously pursued negotiations toward settlement,” Judge Griesa wrote in his ruling on Friday. “The injunctions, once appropriate to address the Republic's recalcitrance, can no longer be justified,” U.S. District Judge Thomas Griesa wrote Friday in his ruling.

“All that has changed,” the judge added, referring to the newly elected president, Mauricio Macri, who has pledged to resolve the debt dispute as part of a bigger plan to overhaul Argentina’s economy.

In recent weeks Macri’s administration has moved to settle with several other holdouts, striking a $1.35 billion settlement with a group of Italian investors, among several other deals. On Feb. 5, after a week of intense negotiations with the group of six holdout hedge funds, it offered to pay $6.5 billion in an effort to put the battle behind it.

Two hedge funds — Montreux Partners and Dart Management — accepted the proposal, which would amount to three-quarters of a $9 billion claim on defaulted bonds.

The four others funds, which include NML Capital and Aurelius Capital Management, a hedge fund run by the former Elliott trader Mark Brodsky, have continued to reject the proposal.

If the court were to refuse to vacate the injunctions now, “it would unfairly deny those plaintiffs the opportunities to resolve their disputes amicably with the Republic,” Judge Griesa wrote on Friday.

He added that “vacating the injunctions serves the public interest by encouraging settlement to resolve disputes generally — particularly such protracted ones — as well as the concern for finality in this particular litigation.”

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsEnd of the line for Singer ???? Let's hope so.

Feb 20th, 2016 - 11:38 am 0The right move.

Feb 20th, 2016 - 01:01 pm 0Now we'll see how long it takes to finish this whole sorry mess.

But closer than when CFK was screeching incessantly about it.

Wheres Singer's trolls now? Some have a hard time understanding Macri is not Kirchner........even Stiuso returned from hiding.

Feb 20th, 2016 - 01:56 pm 0Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!